About IST

The Tribunal is an independent specialised judicial body established under Section 274 of Investments and Securities Act (ISA) 2007 to adjudicate capital market disputes and to interpret any law, rules or regulations as may be applicable.

MoreMEETING AT FINANCE

MOREWORKSHOP

ONE-DAY WORKSHOP ON LAW, PRACTICE AND PROCEDURE OF THE INVESTMENTS AND SECURITES TRIBUNAL IN CONJUCTION WITH NBA(UNITY BRANCH ABUJA) AND SEC

MORERIVER STATE JUDICARY IN COLLABORATION WITH IST

THE ROLE OF INVESTMENT & SECURITIES TRIBUNAL IN CAPITAL MARKET DISPUTES.

FOR MOREIST SEEKS BILATERAL TIES WITH TAIWAN

INVESTMENTS AND SECURITIES TRIBUNAL SEEKS BILATERAL TIES WITH TAIWAN

MOREOur Services

1

ALTERNATIVE DISPUTE RESOLUTION

A structured process to dedicate more time and attention to the creation of a voluntary and durable agreement tailored to meet the needs of the particular parties

2

LITIGATION

The Investments and Securities Tribunal (Procedure) Rules 2014 provides the Forms for commencement of proceedings in the Tribunal in the Schedules to the Rules.

3

OMBUDSMAN

The Tribunal provides help desk services to litigants, counsel, and the general public. Inquiries and complaints are handled via letters, emails, phone calls, and walk-in visits.

The IST is a critical part of the Nigerian Capital Market Ecosystem, in the quest to make Nigeria an investment destination of choice in Africa.

The Tribunal has its mandate the expeditious determination of cases brought before it within a period of three (3) months from the date of commencement of the hearing of the substantive suit, with a view to build and maintain investors confidence.

In achieving our mandate the Tribunal leverages on the expertise of its members, who are seasoned professionals with in-depth knowledge of experience in securities and investment laws, legal and capital market activities. Indeed the decisions of the Tribunal have deepened the jurisprudence of the capital market.

Our proceedings are further helped by its rule of procedure which admits of no technicalities but focus on doing substantial justice to the parties. Parties can also by mutual consent opt to have their grievances resolved to vide a much cordialmediation process which is parties driven and makes for a continous friendly business relationship.

CAUSELIST/JUDGEMENT

| Sitting Date | Case No. | Panel | |

|---|---|---|---|

| THIS WEDNESDAY, 25TH FEBRUARY, 2026 | IST/OA/02/2025 (HEARING) SECURITIES & EXCHANGE COMMISSION V CRYPTO BRIDGE EXCHANGE (CBEX) & 25 ORS | Hon. Junaidu Aminu Hon. Chairman Hon. Gboyega Oyekanmi Hon. Member Hon. Shehu Lawal Mandiya Hon. Member Hon. Olatunde M. Amolegba Hon. Member Hon. Udegbulam A. Chukwuemeka Hon. Member Hon. Ali Sadiq Mohammed Hon. Member | |

| THIS TUESDAY, 24TH FEBRUARY, 2026. | IST/OA/05/2025 (HEARING) CHINEDU EKEH V SECURITIES AND EXCHANGE COMMISSION | Hon. Gboyega Oyekanmi Presiding Chairman Hon. Robert Uchenna O. Hon. Member Hon. Osaze Ize –Iyamu Hon. Member Hon. Ummahani Ahmad Amin Hon. Member Hon. Ali Sadiq Mohammed Hon. Member | |

| THIS TUESDAY, 24TH FEBRUARY, 2026. | IST/OA/02/2024 M/N-IST/M/02/2026 (HEARING) NORRENBERGER PENSION LTD V CAPITAL TRUST INVESTMENT & ASSET MANAGEMENT & 20 ORS | Hon. Felix Onwuneme Presiding Chairman Hon. Shehu Lawal Mandiya Hon. Member Hon. Osaze Ize –Iyamu Hon. Member Hon. Ali Sadiq Mohammed Hon. Member Hon Udegbulam A. Chukwuemeka Hon. Member | |

| THIS TUESDAY, 24TH FEBRUARY, 2026. | IST/APP/02/2006 (ROS/HEARING) BENUE INVESTMENT PROPERTY CO. LTD & ANOR V SECURITIES & EXCHANGE COMMISSION & 6 ORS | Hon. Junaidu Aminu Hon. Chairman Hon. Gboyega Oyekanmi Hon. Member Hon. Felix Onwuneme Hon. Member Hon. Robert Uchenna O. Hon. Member | |

| THIS TUESDAY, 24TH FEBRUARY, 2026. | IST/APP/01/2025 (HEARING) MAVEN ASSET MGT LTD V SECURITIES & EXCHANGE COMMISSION & ANOR | Hon. Junaidu Aminu Hon. Chairman Hon. Felix Onwuneme Hon. Member Hon. Robert Uchenna O. Hon. Member Hon. Ummahani Ahmad Amin Hon. Member Hon. Kamarudeen Oladosu Hon. Member Hon. Olatunde M. Amolegba Hon. Member | |

| THIS TUESDAY, 24TH JUNE, 2025 | IST/APP/02/2006 IST/M/12/2025 (HEARING) BENUE INVST. & PROPERTY COMPANY LTD & ANOR V. SECURITIES & EXCHANGE COMMISSION & 4 ORS. | Amos I. Azi Hon. Chairman Jude I. Udunni Hon. Member Abubakar A. Ahmed Hon. Member Albert L. Otesile Hon. Member | |

| THIS TUESDAY, 24TH JUNE, 2025 | IST/OA/02/2025 (HEARING) SECURITIES & EXCHANGE COMMISSION V. CRYPTO BRIDGE EXCHANGE (CBEX) & 22 ORS. | Amos I. Azi Hon. Chairman Jude I. Udunni Hon. Member Abubakar A. Ahmed Hon. Member Emeka Madubuike Hon. Member Albert L. Otesile Hon. Member | |

| THIS MONDAY, 12TH MAY, 2025. | 1. IST/M/10/2025 BENUE INVESTMENT PROPERTY CO. LTD & ANOR HEARING V SECURITIES & EXCHANGE COMMISSION & 4 ORS | Amos I. Azi Hon. Chairman Jude I. Udunni Hon. Member Abubakar A. Ahmad Hon. Member Albert L. Otesile Hon. Member | |

| THIS MONDAY, 31ST JULY, 2023 | IST/OA/08/2022: JUDGMENT SECURITIES AND EXCHANGE COMMISSION V UK-DION INVESTMENT LIMITED & 20 ORS | Amos Azi Hon. Chairman Jude I. Udunni Hon. Member Nosa Osemwengie Hon. Member Abubakar A. Ahmad Hon. Member Albert L. Otesile Hon. Member | |

| THIS FRIDAY 21ST JULY, 2023. | 1. IST/OA/01/2023 HEARING VICTOR OLAWALE BARRETTO V CENTRAL SECURITIES CLEARING SYSTEM PLC & 3 ORS. | Amos Azi Hon. Chairman Abubakar A. Ahmad Hon. Member Eric Elujekor Hon. Member Albert L. Otesile Hon. Member Kasumi Kurfi Hon. Member | |

| THIS THURSDAY 20TH JULY, 2023. | 1. IST/OA/01/2023 HEARING VICTOR OLAWALE BARRETTO V CENTRAL SECURITIES CLEARING SYSTEM PLC & 3 ORS. | Amos Azi Hon. Chairman Abubakar A. Ahmad Hon. Member Eric Elujekor Hon. Member Albert L. Otesile Hon. Member Kasumi Kurfi Hon. Member | |

| THIS THURSDAY 20TH JULY, 2023 | 2. IST/OA/02/2023 HEARING SOLOMON YAWO NELSON & 4 ORS. V UK-DION INVESTMENT LTD & ANOR. | Amos Azi Hon. Chairman Gboyega Oyekanmi Hon. Member Nosa Osemwengie Hon. Member Emeka Madubuike Hon. Member | |

| THIS THURSDAY 20TH JULY, 2023. | 1. IST/OA/03/2023 HEARING ANDREW UWUILEKHUE V SECURITIES AND EXCHANGE COMMISSION | Nosa Osemwengie Presiding Chairman Gboyega Oyekanmi Hon. Member Emeka Madubuike Hon. Member Jude I. Udunni Hon Member | |

| THIS THURSDAY 8TH JUNE, 2023. | IST/LA/10/2014 M/N-IST/M/04/2023 RULING SOLOMON OLUJIDE AJAO V ZENITH SECURITIES LTD (NOW QUANTUM ZENITH SECURITIES INVESTMENTS LTD) | Nosa Osemwengie Presiding Chairman Jude I. Udunni Hon. Member Abubakar A. Ahmad Hon. Member Alber L. Otesile Hon. Member Mamman Zargana Hon. Member | |

| THIS THURSDAY 8TH JUNE, 2023. | IST/OA/03/2022 JUDGMENT SECURITIES AND EXCHANGE COMMISSION V FARMFORTE AGRO & ALLIED SOLUTIONS LTD & 3 ORS | Abubakar A. Ahmad Presiding Chairman Nosa Osemwengie Hon. Member Jude I. Udunni Hon. Member Albert L. Otesile Hon. Member Emeka Madubuike Hon. Member | |

| THIS WEDNESDAY 7TH JUNE, 2023. | IST/OA/01/2023 HEARING VICTOR OLAWALE BARRETTO V CENTRAL SECURITIES CLEARING SYESTEM PLC & 3 ORS. | Amos Azi Hon. Chairman Abubakar A. Ahmad Hon. Member Eric Elujekor Hon. Member Albert L. Otesile Hon. Member Kasumi Kurfi Hon. Member | |

| THIS WEDNESDAY 7TH JUNE, 2023. | IST/OA/02/2023 HEARING SOLOMON YAWO NELSON & 4 ORS. V UK-DION INVESTMENT LTD & ANOR. | Amos Azi Hon. Chairman Gboyega Oyekanmi Hon. Member Nosa Osemwengie Hon. Member Emeka Madubuike Hon. Member | |

| THIS WEDNESDAY 7TH JUNE, 2023. | IST/OA/03/2023 HEARING ANDREW UWUILEKHUE V SECURITIES AND EXCHANGE COMMISSION | Nosa Osemwengie Presiding Chairman Gboyega Oyekanmi Hon. Member Emeka Madubuike Hon. Member Jude I. Udunni Hon Member | |

| THIS FRIDAY, 31ST MARCH, 2023. | IST/OA/08/2022: HEARING SECURITIES AND EXCHANGE COMMISSION V UK-DION INVESTMENT LIMITED & 20 ORS | Amos Azi Hon. Chairman Jude I. Udunni Hon. Member Nosa Osemwengie Hon. Member Abubakar A. Ahmad Hon. Member Albert L. Otesile Hon. Member | |

| THIS FRIDAY, 31ST MARCH, 2023. | IST/OA/03/2022: HEARING SECURITIES AND EXCHANGE COMMISSION V FARMFORTE AGRO & ALLIED SOLUTIONS LTD & 37 ORS | Abubakar A. Ahmad Presiding Chairman Nosa Osemwengie Hon. Member Jude I. Udunni Hon. Member Albert Otesile Hon. Member Emeka Madubuike Hon. Member | |

| THIS WEDNESDAY, 22ND MARCH, 2023. | 1.IST/LA/OA/10/2014 M/N – IST/M/04/2023 HEARING SOLOMON OLUJIDE AJAO V ZENITH SECURITIES LTD (NOW QUANTUM ZENITH SECURITIES INVESTMENTS LTD) | Nosa Osemwengie Presiding Chairman Jude I. Udunni Member Abubakar A. Ahmad Member Albert L. Otesile Member Mamman Zargana Member | |

| THIS WEDNESDAY, 22ND MARCH, 2023. | IST/OA/03/2022: HEARING SECURITIES AND EXCHANGE COMMISSION V FARMFORTE AGRO & ALLIED SOLUTIONS LTD & 37 ORS | Abubakar A. Ahmad Presiding Chairman Nosa Osemwengie Hon. Member Jude I. Udunni Hon. Member Albert Otesile Hon. Member Emeka Madubuike Hon. Member | |

| THIS WEDNESDAY, 22ND MARCH, 2023. | IST/OA/09/2022 HEARING HON. YAKUBU DOGARA M/N – IST/M/09/2023 V CASHCRAFT ASSETS MGT. LTD & 2 ORS | Jude I. Udunni Presiding Chairman Kasumi G. Kurfi Hon. Member Albert L. Otesile Hon. Member Nosa Osemwengie Hon. Member | |

| THIS FRIDAY, 17TH FEBRUARY, 2023. | IST/OA/08/2022: SECURITIES AND EXCHANGE COMMISSION HEARING V UK-DION INVESTMENT LIMITED & 20 ORS | Amos Azi Hon. Chairman Jude I. Udunni Hon. Member Nosa Osemwengie Hon. Member Abubakar A. Ahmad Hon. Member Albert L. Otesile Hon. Member | |

| THIS FRIDAY, 17TH FEBRUARY, 2023. | 2. IST/LA/OA/10/2014 SOLOMON OLUJIDE AJAO M/N – IST/M/04/2023 V HEARING ZENITH SECURITIES LTD (NOW QUANTUM ZENITH SECURITIES INVESTMENTS LTD) | Nosa Osemwengie Presiding Chairman Jude I Udunni Member Abubakar A. Ahmad Member Albert L. Otesile Member Mamman Zargana Member | |

| THIS WEDNESDAY, 1ST FEBRUARY, 2023. | IST/OA/08/2022: SECURITIES AND EXCHANGE COMMISSION HEARING V UK-DION INVESTMENT LIMITED & 20 ORS | Amos Azi Hon. Chairman Jude I. Udunni Hon. Member Nosa Osemwengie Hon. Member Abubakar A. Ahmad Hon. Member Albert L. Otesile Hon. Member | |

| THIS WEDNESDAY, 1ST FEBRUARY, 2023. | IST/OA/03/2022: SECURITIES AND EXCHANGE COMMISSION HEARING V FARMFORTE AGRO & ALLIED SOLUTIONS LTD & 37 ORS | Abubakar A. Ahmad Presiding Chairman Nosa Osemwengie Hon. Member Jude I. Udunni Hon. Member Albert Otesile Hon. Member Emeka Madubuike Hon. Member | |

| THIS TUESDAY, 24TH JANUARY 2023. | 1. IST/OA/08/2022: SECURITIES AND EXCHANGE COMMISSION HEARING V UK-DION INVESTMENT LIMITED & 20 ORS | Amos Azi Hon. Chairman Jude I. Udunni Hon. Member Nosa Osemwengie Hon. Member Abubakar A. Ahmad Hon. Member Albert L. Otesile Hon. Member | |

| THIS TUESDAY, 24TH JANUARY 2023. | . IST/OA/03/2022: SECURITIES AND EXCHANGE COMMISSION HEARING V FARMFORTE AGRO & ALLIED SOLUTIONS LTD & 37 ORS | Abubakar A. Ahmad Presiding Chairman Nosa Osemwengie Hon. Member Jude I. Udunni Hon. Member Albert Otesile Hon. Member Emeka Madubuike Hon. Member | |

| THIS TUESDAY, 24TH JANUARY 2023. | IST/OA/09/2022 HON. YAKUBU DOGARA JUDGMENT V CASHCRAFT ASSETS MGT. LTD & 2 ORS | Jude I. Udunni Presiding Chairman Kasumi G. Kurfi Hon. Member Albert L. Otesile Hon. Member Nosa Osemwengie Hon. Member | |

| THIS TUESDAY, 24TH JANUARY 2023. | 4. IST/OA/05/2022: HEARING SECURITIES AND EXCHANGE COMMISSSION V. OVAIOZA FARM PRODUCE STORAGE BUSINESS LTD & 6 ORS | Jude I. Udunni Presiding Chairman Abubakar A. Ahmad Hon. Member Nosa Osemwengie Hon. Member Albert Otesile Hon. Member Mamman Zargana Hon. Member | |

| THIS TUESDAY 29TH NOVEMBER, 2022. | . IST/OA/06/2022 SECURITIES AND EXCHANGE COMMISSION JUDGMENT V ELIXIR ASSET MGT LTD & 16 ORS. | Amos Azi Hon. Chairman Jude I. Udunni Hon. Member Dr.Abubakar A. Ahmad Hon. Member Kasumi G. Kurfi Hon. Member Albert L. Otesile Hon. Member | |

| THIS TUESDAY 29TH NOVEMBER, 2022. | . IST/OA/08/2022 SECURITIES AND EXCHANGE COMMISSION HEARING V UK-DION INVESTMENT LIMITED & 20 ORS | Amos Azi Hon. Chairman Jude I. Udunni Hon. Member Nosa Osemwengie Hon. Member Abubakar A. Ahmad Hon. Member Albert L. Otesile Hon. Member | |

| THIS THURSDAY, 24TH NOVEMBER 2022. | IST/OA/03/2022 SECURITIES AND EXCHANGE COMMISSION DEFINITE HEARING V FARMFORTE AGRO & ALLIED SOLUTIONS LTD & 37 ORS | Abubakar A. Ahmad Presiding Chairman Nosa Osemwengie Hon. Member Jude I. Udunni Hon. Member Albert Otesile Hon. Member Emeka Madubuike Hon. Member | |

| THIS WEDNESDAY, 2ND NOVEMBER 2022 | IST/OA/08/2022: SECURITIES AND EXCHANGE COMMISSION HEARING V UK-DION INVESTMENT LIMITED & 20 ORS | Amos Azi Hon. Chairman Jude I. Udunni Hon. Member Nosa Osemwengie Hon. Member Abubakar A. Ahmad Hon. Member Albert L. Otesile Hon. Member | |

| THIS THURSDAY, 27TH OCTOBER, 2022. | 2. IST/OA/09/2022 HON. YAKUBU DOGARA HEARING V CASHCRAFT ASSETS MGT. LTD & 2 ORS | Jude I. Udunni Presiding Chairman Kasumi G. Kurfi Hon. Member Albert L. Otesile Hon. Member Nosa Osemwengie Hon. Member | |

| THIS WEDNESDAY, 26TH OCTOBER, 2022. | 2. IST/OA/09/2022 HON. YAKUBU DOGARA HEARING V CASHCRAFT ASSETS MGT. LTD & 2 ORS | Jude I. Udunni Presiding Chairman Kasumi G. Kurfi Hon. Member Albert L. Otesile Hon. Member Nosa Osemwengie Hon. Member | |

| THIS TUESDAY, 11TH OCTOBER 2022. | IST/OA/08/2022: SECURITIES AND EXCHANGE COMMISSION HEARING V UK-DION INVESTMENT LIMITED & 20 ORS | Amos Azi Honourable Chairman Jude I. Udunni Hon. Member Nosa Osemwengie Hon. Member Abubakar A. Ahmad Hon. Member Albert L. Otesile Hon. Member | |

| THIS TUESDAY, 11TH OCTOBER 2022. | 2. IST/OA/09/2022 HON. YAKUBU DOGARA HEARING V CASHCRAFT ASSETS MGT. LTD & 2 ORS | Jude I. Udunni Presiding Chairman Kasumi G. Kurfi Hon. Member Albert L. Otesile Hon. Member Nosa Osemwengie Hon. Member | |

| THIS TUESDAY, 11TH OCTOBER 2022. | 3. IST/OA/04/2022 SECURITIES AND EXCHANGE COMMISSION JUDGMENT V KAYODE VIKTOR SAL & 6 ORS. | Eric Elujekor Presiding Chairman Gboyega Oyekanmi Hon. Member Albert L. Otesile Hon. Member Abubakar A. Ahmad Hon. Member Mamman Zargana Hon. Member | |

| THIS WEDNESDAY 12TH OCTOBER, 2022. | IST/OA/06/2022 SECURITIES AND EXCHANGE COMMISSIO HEARING V ELIXIR ASSET MGT LTD & 16 ORS. | Amos Azi Honourable Chairman Jude I. Udunni Hon. Member Dr.Abubakar A. Ahmad Hon. Member Kasumi G. Kurfi Hon. Member Albert L. Otesile Hon. Member | |

| THIS WEDNESDAY 12TH OCTOBER, 2022. | . IST/OA/05/2022: HEARING SECURITIES AND EXCHANGE COMMISSSION V. OVAIOZA FARM PRODUCE STORAGE BUSINESS LTD & 6 ORS | Jude I. Udunni Presiding Chairman Abubakar A. Ahmad Hon. Member Nosa Osemwengie Hon. Member Albert Otesile Hon. Member Mamman Zargana Hon. Member | |

| THIS WEDNESDAY 12TH OCTOBER, 2022. | 3. IST/OA/03/2022: SECURITIES AND EXCHANGE COMMISSION Ruling: 10:00am V FARMFORTE AGRO & ALLIED SOLUTIONS LTD & 37 ORS | Abubakar A. Ahmad Presiding Chairman Nosa Osemwengie Hon. Member Jude I. Udunni Hon. Member Albert Otesile Hon. Member Emeka Madubuike Hon. Member | |

| MONDAY 5TH SEPTEMBER, 2022 | IST/OA/09/2022 HEARING HON. YAKUBU DOGARAV CASHCRAFT ASSETS MGT. LTD & ANOR | Amos Azi [Hon. Chairman] Jude I. Udunni [Hon. Member] Abubakar A. Ahmad [Hon. Member] Albert Otesile [Hon. Member] Kasumi G. Kurfi[Hon. Member] | |

| MONDAY 5TH SEPTEMBER, 2022 | IST/OA/06/2022 DEFINITE HEARING SECURITIES AND EXCHANGE COMMISSIONV ELIXIR ASSET MGT LTD & 16 ORS. | Amos Azi [Hon. Chairman] Jude I. Udunni [Hon. Member] Abubakar A. Ahmad [Hon. Member] Albert Otesile [Hon. Member] Kasumi G. Kurfi[Hon. Member] | |

| MONDAY 5TH SEPTEMBER, 2022 | IST/OA/08/2022 HEARING SECURITIES AND EXCHANGE COMMISSIONV UK-DION INVESTMENT LIMITED & 20 ORS | Amos Azi [Hon. Chairman] Jude I. Udunni [Hon. Member] Abubakar A. Ahmad [Hon. Member] Albert Otesile [Hon. Member] Nosa Osemwengie[Hon. Member] | |

| MONDAY 5TH SEPTEMBER, 2022 | IST/OA/05/2022 HEARING SECURITIES AND EXCHANGE COMMISSIONV OVAIOZA FARM PRODUCE STORAGE BUSINESS LTD & 6 ORS | Jude I. Udunni [Presiding Chairman] Mamman Zargana [Hon. Member] Abubakar A. Ahmad [Hon. Member] Albert Otesile [Hon. Member] Nosa Osemwengie[Hon. Member] | |

| MONDAY 5TH SEPTEMBER, 2022 | IST/OA/03/2022 ROS SECURITIES AND EXCHANGE COMMISSIONV FARMFORTE AGRO & ALLIED SOLUTIONS LTD & 37 ORS | Abubakar A. Ahmad [Presiding Chairman] Jude I. Udunni [Hon. Member] Emeka Madubuike [Hon. Member] Albert Otesile [Hon. Member] Nosa Osemwengie[Hon. Member] | |

| TUESDAY 6TH SEPTEMBER, 2022 | IST/OA/06/2022 DEFINITE HEARING SECURITIES AND EXCHANGE COMMISSIONV ELIXIR ASSET MGT LTD & 16 ORS. | Amos Azi [Hon. Chairman] Jude I. Udunni [Hon. Member] Abubakar A. Ahmad [Hon. Member] Albert Otesile [Hon. Member] Kasumi G. Kurfi[Hon. Member] | |

| MONDAY 1ST AUGUST, 2022 | IST/OA/06/2022 HEARING SECURITIES AND EXCHANGE COMMISSSION V ELIXIR ASSET MGT LTD & 16 ORS. | Amos Azi [Hon. Chairman] Ike Udunni [Hon. Member] Abubakar A. Ahmad [Hon. Member] Albert Otesile [Hon. Member] Kasumi G. Kurfi[Hon. Member] | |

| MONDAY 1ST AUGUST, 2022 | IST/OA/08/2022 HEARING SECURITIES AND EXCHANGE COMMISSSION V UK-DION INVESTMENT LIMITED & 20 ORS | Amos Azi [Hon. Chairman] Ike Udunni [Hon. Member] Abubakar A. Ahmad [Hon. Member] Albert Otesile [Hon. Member] Nosa Osemwengie[Hon. Member] | |

| WEDNESSDAY 20TH JULY, 2022 | IST/OA/06/2022 HEARING SECURITIES AND EXCHANGE COMMISSSION V ELIXIR ASSET MGT LTD & 16 ORS. | Amos Azi [Hon. Chairman] Ike Udunni [Hon. Member] Abubakar A. Ahmad [Hon. Member] Albert Otesile [Hon. Member] Kasumi G. Kurfi[Hon. Member] | |

| WEDNESSDAY 20TH JULY, 2022 | IST/OA/07/2022 HEARING HON. YAKUBU DOGARA TOWER V CASHCRAFT ASSETS MGT. LTD & ANOR | Amos Azi [Hon. Chairman] Ike Udunni [Hon. Member] Abubakar A. Ahmad [Hon. Member] Albert Otesile [Hon. Member] Kasumi G. Kurfi[Hon. Member] | |

| WEDNESSDAY 20TH JULY, 2022 | IST/OA/01/2022 HEARING SECURITIES AND EXCHANGE COMMISSIONV FINAFRICA INVEST. LTD & 18 ORS | Nosa S. Osemwengie [Presiding Chairman] Ike Udunni [Hon. Member] Abubakar A. Ahmad [Hon. Member] Albert Otesile [Hon. Member] | |

| WEDNESSDAY 20TH JULY, 2022 | IST/OA/04/2022 HEARING SECURITIES AND EXCHANGE COMMISSIONV KAYODE VIKTOR SAL & 6 ORS. | Eric Elujekor [Presiding Chairman] Dr. Abubakar A. Ahmad[Hon. Member] Gboyega Oyekanmi [Hon. Member] Albert Otesile [Hon. Member] Mamman Zargana [Hon. Member] | |

| MONDAY 18TH JULY, 2022 | IST/OA/08/2022: EX PARTE HEARING @ 9am SECURITIES AND EXCHANGE COMMISSSION V UK-DION INVESTMENT LIMITED & 20 ORS | Amos Azi [Hon. Chairman] Ike Udunni [Hon. Member] Nosa Osemwengie[Hon. Member] Albert Otesile [Hon. Member] Abubakar A. Ahmad [Hon. Member] | |

| TUESDAY 5TH JULY, 2022 | IST/OA/03/2022: ROS/HEARING SECURITIES AND EXCHANGE COMMISSSION V FARMFORTE AGRO &ALLIED SOLUTIONS LTD & 37 ORS | Abubakar A. Ahmad [Presiding Chairman] Nosa Osemwengie [Hon. Member] Jude I. Udunni [Hon. Member] Albert Otesile [Hon. Member] Emeka Madubuike [Hon. Member] | |

| TUESDAY 5TH JULY, 2022 | IST/OA/04/2022 HEARING SECURITIES AND EXCHANGE COMMISSSION V KAYODE VIKTOR SAL & 6 ORS | Eric Elujekor [Presiding Chairman] Abubakar A. Ahmad [Hon. Member] Gboyega Oyekanmi [Hon. Member] Albert Otesile [Hon. Member] Mamman Zargana [Hon. Member] | |

| TUESDAY 5TH JULY, 2022 | IST/OA/05/2022: HEARING SECURITIES AND EXCHANGE COMMISSSION V OVAIOZA FARM PRODUCE STORAGE BUSINESS LTD & 6 ORS | Jude I. Udunni [Presiding Chairman] Nosa Osemwengie [Hon. Member] Abubakar A. Ahmad [Hon. Member] Albert Otesile [Hon. Member] Mamman Zargana [Hon. Member] | |

| TUESDAY 14TH JUNE, 2022 | IST/OA/06/2022 SECURITIES & EXCHANGE COMMISSION HEARING V ELIXIR ASSET MANAGEMENT LTD. & 16 ORS. | Amos I. Azi [Hon. Chairman] Jude I. Udunni [Hon. Member] Abubakar A. Ahmad [Hon. Member] Albert Otesile [Hon. Member] Kasimu Kurfi [Hon. Member] | |

| TUESDAY 14TH JUNE, 2022 | IST/OA/07/2022: HEARING HON. YAKUBU DOGARA V CASHCRAFT ASSET MANAGEMENT LTD. & ANOR. | Amos I. Azi [Hon. Chairman] Nosa Osemwengie [Hon. Member] Gboyega Oyekanmi [Hon. Member] Albert Otesile [Hon. Member] Emeka Madubike[Hon. Member] | |

| TUESDAY 14TH JUNE, 2022 | IST/OA/01/2022: HEARING SECURITIES AND EXCHANGE COMMISSION V FINAFRICA INVEST. LTD & 18 ORS | Nosa S. Osemwengie [Presiding Chairman] Jude I. Udunni [Hon. Member] Abubakar A. Ahmad [Hon. Member] Albert Otesile [Hon. Member] | |

| TUESDAY 14TH JUNE, 2022 | 2. IST/OA/04/2022: HEARING @ 9.00 am SECURITIES AND EXCHANGE COMMISSION V KAYODE VIKTOR SAL & 6 ORS. | Eric Elujekor [Presiding Chairman] Gboyega Oyekanmi [Hon. Member] Abubakar A. Ahmad [Hon. Member] Albert Otesile [Hon. Member] Mamman Zargana [Hon. Member] | |

| WEDNESDAY 15TH JUNE, 2022 | IST/OA/01/2021: HEARING TOWER ASSETS MGT. LTD V SECURITIES AND EXCHANGE COMMISSION & 2 ORS | Abubakar A. Ahmad [Presiding Chairman] Jude I. Udunni [Hon. Member] Mamman Zargana [Hon. Member] Kasimu G. Kurfi [Hon. Member] | |

| WEDNESDAY 17TH MAY, 2022 | IST/OA/02/2022:HEARING @ 9.00 am SECURITIES AND EXCHANGE COMMISSION V. OXFORD COMMERCIAL SERVICE INTERNATIONAL LTD & 7 ORS | Amos Azi [Honourable Chairman] Jude I. Udunni [Hon. Member] Abubakar A. Ahmad [Hon. Member] Albert L. Otesile [Hon. Member] Kasumi G. Kurfi [Hon. Member] | |

| TUESDAY 17TH MAY, 2022 | IST/OA/04/2022: Hearing SECURITIES AND EXCHANGE COMMISSION V KAYODE VIKTOR SAL & 6 ORS | Eric Elujekor [Presiding Chairman] Gboyega Oyekanmi [Hon. Member] Albert L. Otesile [Hon. Member] Dr. Abubakar A. Ahmad [Hon. Member] Mamman Zargana [Hon. Member] | |

| TUESDAY 17TH MAY, 2022 | IST/OA/01/2021: Hearing TOWER ASSETS MGT. LTD V SECURITIES AND EXCHANGE COMMISSION & 2 ORS | Jude I. Udunni [Presiding Chairman] Dr. Abubakar A. Ahmad [Hon. Member] Kasumi G. Kurfi [Hon. Member] Mamman Zargana [Hon. Member] | |

| TUESDAY 17TH MAY, 2022 | IST/OA/01/2022: Hearing SECURITIES AND EXCHANGE COMMISSION V FINAFRICA INVEST. LTD & 18 ORS | Nosa S. Osemwengie [Presiding Chairman] Jude I. Udunni [Hon. Member] Albert I. Otesile [Hon. Member] | |

| TUESDAY 17TH MAY, 2022 | IST/OA/03/2022: ROS/Hearing SECURITIES AND EXCHANGE COMMISSSION V FARMFORTE AGRO & ALLIED SOLUTIONS LTD & 37 ORS | Abubakar A. Ahmad [Presiding Chairman] Nosa Osemwengie [Hon. Member] Jude I. Udunni [Hon. Member] Albert Otesile [Hon. Member] Emeka Madubuike [Hon. Member] | |

| TUESDAY 17TH MAY, 2022 | IST/OA/05/2022: Hearing SECURITIES AND EXCHANGE COMMISSSION V. OVAIOZA FARM PRODUCE STORAGE BUSINESS LTD & 6 ORS | Jude I. Udunni [Presiding Chairman] Abubakar A. Ahmad [Hon. Member] Nosa Osemwengie [Hon. Member] Albert Otesile [Hon. Member] Mamman Zargana [Hon. Member] | |

| WEDNESDAY 11TH MAY, 2022 | IST/OA/02/2022: Hearing @ 9.00 am SECURITIES AND EXCHANGE COMMISSION V. OXFORD COMMERCIAL SERVICE INTERNATIONAL LTD & 7 ORS | Amos Azi [Honourable Chairman] Jude I. Udunni [Hon. Member] Abubakar A. Ahmad [Hon. Member] Albert L. Otesile [Hon. Member] Kasumi G. Kurfi [Hon. Member] | |

| TUESDAY 12TH APRIL, 2022 | IST/OA/03/2022:ROS/Hearing [9 AM] SECURITIES AND EXCHANGE COMMISSSION V.FARMFORTE AGRO & ALLIED SOLUTIONS LTD & 37 ORS | Dr. Abubakar A. Ahmad [Presiding Chairman] Nosa Osemwengie [Hon. Member] Jude I. Udunni [Hon. Member] Albert Otesile [Hon. Member] Emeka Madubuike [Hon. Member] | |

| TUESDAY 12TH APRIL, 2022 | IST/OA/05/2022:Hearing [11 AM] SECURITIES AND EXCHANGE COMMISSSION V. OVAIOZA FARM PRODUCE STORAGE BUSINESS LTD & 6 ORS | Jude I. Udunni [Presiding Chairman] Dr. Abubakar A. Ahmad [Hon. Member] Nosa Osemwengie [Hon. Member] Albert Otesile [Hon. Member] Mamman Zargana [Hon. Member] | |

| TUESDAY 5TH APRIL, 2022 | IST/OA/02/2022: HEARING SECURITIES AND EXCHANGE COMMISSION V. OXFORD COMMERCIAL SERVICE INTL. LTD & 7 ORS | Amos Azi [Honourable Chairman] Jude I. Udunni [Hon. Member] Dr. Abubakar A. Ahmad [Hon. Member] Albert L. Otesile [Hon. Member] Kasumi G. Kurfi [Hon. Member] | |

| TUESDAY 5TH APRIL, 2022 | IST/OA/03/2022: HEARING SECURITIES AND EXCHANGE COMMISSION V. FARMFORTE AGRO & ALLIED SOLUTIONS LTD& 37 ORS | Dr. Abubakar A. Ahmad [Presiding Chairman] Nosa Osemwengie [Hon. Member] Jude I. Udunni [Hon. Member] Albert L. Otesile [Hon. Member] Emeka Madubuike [Hon. Member] | |

| TUESDAY 5TH APRIL, 2022 | IST/OA/04/2022: Hearing SECURITIES SND EXCHANGE COMMISSION V. KAYODE VIKTOR SAL & 6 ORS. | Amos Azi [Honourable Chairman] Eric Elujekor [Hon. Member] Gbenga Oyekanmi [Hon. Member] Albert L. Otesile [Hon. Member] Dr. Abubakar A. Ahmad [Hon. Member] | |

| 3RD DAY OF MARCH, 2022 | IST/OA/01/2021: Report of settlement TOWER ASSETS MANAGEMENT LIMITED. V. SECURITIES AND EXCHANGE COMMISSSION & 2 ORS | Jude I. Udunni (Presiding Chairman) Dr. Abubakar A. Ahmad (Hon. Member) Kasumi G. Kurfi (Hon. Member) Mamman Bukar Zargana (Hon. Member) | |

| 26TH DAY OF APRIL, 2022 | IST/LA/OA/06/2021 – Hearing of Motion IST/M/LA/10/2022 @ 9.00 am OLUSOLA AKINYEDE V STANBIC IBTC ASSET MANAGEMENT LTD & ANOR | Amos I. Azi [Hon. Chairman] Jude I. Udunni [Hon. Member] Emeka C. Madubuike [Hon. Member] Gboyega Oyekanmi [Hon. Member] Kasumi G. Kurfi [Hon. Member] | |

| 17TH DAY OF FEBRUARY, 2022 | IST/OA/01/2022: Def. Hearing SECURITIES AND EXCHANGE COMMISSSION V FINAFRICA INVEST. LTD & 18 ORS | NOSA S. OSEMWENGIE (Presiding Chairman) JUDE I. UDUNNI (Hon. Member) ALBERT L. OTESILE (Hon. Member) | |

| 8TH DAY OF DECEMBER, 2021 | IST/OA/01/2021: Def. Hearing TOWER ASSETS MANAGEMENT LIMITED. V. SECURITIES AND EXCHANGE COMMISSSION & 2 ORS | Jude I. Udunni (Presiding Chairman) Dr. Abubakar A. Ahmad (Hon. Member) Kasumi G. Kurfi (Hon. Member) Mamman Bukar Zargana (Hon. Member) | |

| 2ND DAY OF NOVEMBER, 2021 | IST/OA/01/2021: Def. Hearing TOWER ASSETS MANAGEMENT LIMITED. V. SECURITIES AND EXCHANGE COMMISSSION & 2 ORS | Jude I. Udunni (Presiding Chairman) Dr. Abubakar A. Ahmad (Hon. Member) Kasumi G. Kurfi (Hon. Member) Mamman Bukar Zargana (Hon. Member) | |

| 1ST DAY OF JUNE, 2021 | IST/OA/01/2020: ROS/ Def. hearing SECURITIES AND EXCHANGE COMMISSSION V. CHAKA TECHNOLOGIES LTD. & ANOR | Amos Azi (Honourable Chairman) Dr. Abubakar A. Ahmad (Hon. Member) Nosa Osemwengie (Hon. Member) Albert L. Otesile (Hon. Member) Mamman Zargana (Hon. Member) | |

| 1ST DAY OF JUNE, 2021 | IST/OA/01/2021: Def. Hearing TOWER ASSETS MANAGEMENT LIMITED. V. SECURITIES AND EXCHANGE COMMISSSION & 2 ORS | Jude I. Udunni (Presiding Chairman) Dr. Abubakar A. Ahmad (Hon. Member) Kasumi G. Kurfi (Hon. Member) Edward Ajayi (Hon. Member) | |

| 15TH DAY OF APRIL, 2021 | IST/OA/01/2020: ROS/Hearing – SECURITIES AND EXCHANGE COMMISSION V. CHAKA TECHNOLOGIES LTD. & ANOR | Amos Azi (Honourable Chairman) Dr. Abubakar A. Ahmad (Hon. Member) Nosa Osemwengie (Hon. Member) Albert L. Otesile (Hon. Member) Mamman Zargana (Hon. Member) | |

| 15TH DAY OF APRIL, 2021 | IST/APP/02/2020: Ruling/Hearing – TOWER ASSETS MANAGEMENT LIMITED V. SECURITIES AND EXCHANGE COMMISSION & 2 ORS. | Jude I. Udunni (Presiding Chairman) Dr. Abubakar A. Ahmad (Hon. Member) Kasumi G. Kurfi (Hon. Member) Edward Ajayi (Hon. Member) |

| SITTING DATE | CASE NO. | PANEL | |||||

|---|---|---|---|---|---|---|---|

| THIS MONDAY 2ND DAY OF MARCH, 2026 | IST/LA/OA/01/2024 – Ruling / Hearing IST/M/LA/11/2025 @ 9.00 am MR. BOSUN AYORINDE V AGROPARTNERSHIP TECHNOLOGY LTD & ORS | Junaidu Aminu Hon. Chairman Felix Onwuneme Hon. Member Robert Uchenna Okwuego Hon. Member Osaze Ize-Iyamu Hon. Member Udegbulem A. Chukwuemeka Hon. Member | |||||

| THIS MONDAY 2ND DAY OF MARCH, 2026 | IST/LA/OA/02/2024 – Ruling / Def. Hearing @ 9.00 am IST/M/LA/12/2025 MR. AYODEJI SALAMI V AGROPARTNERSHIP TECHNOLOGY LTD & ORS | Junaidu Aminu Hon. Chairman Gboyega Oyekanmi Hon. Member Shehu Lawal Mandiya Hon. Member Robert Uchenna Okwuego Hon. Member Olatunde M. Amolegbe Hon. Member Kamarudeen Oladosu Hon. Member | |||||

| THIS MONDAY 2ND DAY OF MARCH, 2026 | IST/LA/OA/03/2024 – Ruling / Cont. of Hearing IST/M/LA/13/2025 @ 9.00 am MR. IKENNA OKORIE V AGROPARTNERSHIP TECHNOLOGY LTD & ORS | Junaidu Aminu Hon. Chairman Gboyega Oyekanmi Hon. Member Felix Onwuneme Hon. Member Shehu Lawal Mandiya Hon. Member Osaze Ize-Iyamu Hon. Member | |||||

| THIS MONDAY 19TH DAY OF MAY, 2025 | 1. IST/LA/OA/01/2025 – Def. Hearing @ 9.00 am ZMAX INVESTMENTS LTD V MAXIFUND INVESTMENTS AND SECURITIES PLC & 2 ORS | Amos I. Azi Hon. Chairman Onyemaechi E. M. Elujekor Hon. Member Gboyega Oyekanmi Hon. Member Albert L. Otesile Hon. Member Emeka C. Madubuike Hon. Member | |||||

| THIS MONDAY 19TH DAY OF MAY, 2025 | 2. IST/LA/OA/10/19 – Hearing of Motion IST/M/LA/04/2025 @ 9.00 am SECURITIES AND EXCHANGE COMMISSION V FIRST STOCKBROKERS LTD & ORS | Dr. Abubakar A. Ahmad Presiding Chairman Albert L. Otesile Hon. Member Mamman B. Zargana Hon. Member | |||||

| THIS MONDAY 28TH DAY OF APRIL, 2025 | 1. IST/LA/OA/04/2024 – Judgment @ 9.00 am OLADIMEJI OGUNLANA V SECURITIES AND EXCHANGE COMMISSION | Amos I. Azi Hon. Chairman Jude I. Udunni Hon. Member Onyemaechi E. M. Elujekor Hon. Member Emeka C. Madubuike Hon. Member | |||||

| THIS MONDAY 28TH DAY OF APRIL, 2025 | 2. IST/LA/OA/01/2025 – Hearing @ 9.00 am ZMAX INVESTMENTS LTD V MAXIFUNDS INVESTMENT AND SECURITIES PLC & 2 ORS | Amos I. Azi Hon. Chairman Onyemaechi E. M. Elujekor Hon. Member Gboyega Oyekanmi Hon. Member Albert L. Otesile Hon. Member Emeka C. Madubuike Hon. Member | |||||

| THIS TUESDAY 8TH DAY OF APRIL, 2025 | 1. IST/LA/OA/05/2024 – Judgment @ 9 .00 am MR. UGWOKEGBE CHARLES CHIKWEM V QUANTUM ZENITH SECURITIES & INVESTMENT LTD & ANOR | Dr. Abubakar A. Ahmad Presiding Chairman Gboyega Oyekanmi Hon. Member Albert L. Otesile Hon. Member Mamman B. Zargana Hon. Member | |||||

| THIS FRIDAY 7TH DAY OF MARCH, 2025 | 1. IST/LA/OA/10/19 – Ruling IST/M/LA/16/2024 @ 9.00 am SECURITIES AND EXCHANGE COMMISSION V FIRST STOCKBROKERS LTD & ORS | Dr. Abubakar A. Ahmad Presiding Chairman Albert L. Otesile Hon. Member Mamman B. Zargana Hon. Member | |||||

| THIS THURSDAY 13TH DAY OF FEBRUARY, 2025 | 1. IST/LA/OA/04/2024 – Def. Hearing @ 9.00 am OLADIMEJI OGUNLA V SECURITIES AND EXCHANGE COMMISSION | Amos I. Azi Hon. Chairman Jude I. Udunni Hon. Member Onyemaechi E. M. Elujekor Hon. Member Emeka C. Madubuike Hon. Member | |||||

| THIS THURSDAY 13TH DAY OF FEBRUARY, 2025 | 2. IST/LA/OA/06/2024 – Report of Settlement / Hearing @ 9.00 am OKEZIE EMMANUEL KANU V BUA GROUP PLC & 3 ORS | Amos I. Azi Hon. Chairman Jude I. Udunni Hon. Member Dr. Abubakar A. Ahmad Hon. Member Albert L. Otesile Hon. Member | |||||

| THIS WEDNESDAY 12TH DAY OF FEBRUARY, 2025 | 1. IST/LA/OA/05/2024 – Def. Hearing @ 9 .00 am MR. UGWOKEGBE CHARLES CHIKWEM V QUANTUM ZENITH SECURITIES & INVESTMENT LTD & ANOR | Dr. Abubakar A. Ahmad Presiding Chairman Gboyega Oyekanmi Hon. Member Albert L. Otesile Hon. Member Mamman B. Zargana Hon. Member | |||||

| THIS WEDNESDAY 22ND DAY OF JANUARY, 2025 | IST/LA/OA/06/2024 – Hearing OKEZIE EMMANUEL KANU @ 9.00 am V BUA GROUP PLC & 3 ORS | Amos I. Azi Hon. Chairman Jude I. Udunni Hon. Member Dr. Abubakar A. Ahmad Hon. Member Albert L. Otesile Hon. Member | |||||

| THIS WEDNESDAY 22ND DAY OF JANUARY, 2025 | IST/LA/OA/10/19 – Hearing IST/M/LA/16/2024 @ 9 .00 am SECURITIES AND EXCHANGE COMMISSION V FIRST STOCKBROKERS LTD & ORS | Dr. Abubakar A. Ahmad Presiding Chairman Albert L. Otesile Hon. Member Mamman B. Zargana Hon. Member | |||||

| THIS WEDNESDAY 22ND DAY OF JANUARY, 2025 | IST/LA/OA/05/2024 – Def. Hearing @ 9 .00 am MR. UGWOKEGBE CHARLES CHIKWEM V QUANTUM ZENITH SECURITIES & INVESTMENT LTD & ANOR | Dr. Abubakar A. Ahmad Presiding Chairman Gboyega Oyekanmi Hon. Member Albert L. Otesile Hon. Member Mamman B. Zargana Hon. Member | |||||

| THIS FRIDAY 3RD DAY OF NOVEMBER, 2023 | IST/LA/OA/01/2023 – Def. Hearing @ 9.00 am VESTRACT COMPANY LTD & ANOR V AGROPARTNERSHIPS TECHNOLOGY LTD & 2 ORS | Amos I. Azi Hon. Chairman Jude I. Udunni Hon. Member Albert L. Otesile Hon. Member Mamman B. Zargana Hon. Member | |||||

| THIS FRIDAY 3RD DAY OF NOVEMBER, 2023 | IST/LA/APP/01/2023 – Hearing @ 9.00 am TAJUDEEN ADEGBOYEGA AKANDE & 3 ORS V SECURITIES & EXCHANGE COMMISSION | Nosa Osemwengie Presiding Chairman Onyemaechi E. M. Elujekor Hon. Member Gboyega Oyekanmi Hon. Member Kasimu G. Kurfi Hon. Member | |||||

| THIS TUESDAY 11TH DAY OF JULY, 2023 | IST/LA/OA/01/2022 – Ruling IST/M/LA/14/2023 @ 9.00 am YAKUBU GARBA GOBIR V GREENWICH REGISTRARS & DATA SOLUTIONS LTD & 4 ORS | Amos I. Azi Hon. Chairman Jude I. Udunni Hon. Member Emeka C. Madubuike Hon. Member Kasimu G. Kurfi Hon. Member | |||||

| THIS TUESDAY 11TH DAY OF JULY, 2023 | IST/LA/OA/01/2023 – Hearing @ 9.00 am VESTRACT COMPANY LTD & ANOR V AGROPARTNERSHIPS LTD | Amos I. Azi Hon. Chairman Jude I. Udunni Hon. Member Albert L. Otesile Hon. Member Mamman B. Zargana Hon. Member | |||||

| THIS TUESDAY 11TH DAY OF JULY, 2023 | IST/LA/OA/07/2022 – Judgment @ 9.00 am MR. TALIAT OLADAPO ADELEYE V CAPITAL TRUST BROKERS LTD & ANOR | Jude I. Udunni Presiding Chairman Dr. Abubakar A. Ahmad Hon. Member Kasimu G. Kurfi Hon. Member Emeka C. Madubuike Hon. Member | |||||

| THIS TUESDAY 11TH DAY OF JULY, 2023 | IST/LA/APP/01/2023 – Hearing @ 9.00 am TAJUDEEN ADEGBOYEGA AKANDE & 3 ORS V SECURITIES & EXCHANGE COMMISSION | Nosa Osemwengie Presiding Chairman Onyemaechi E. M. Elujekor Hon. Member Gboyega Oyekanmi Hon. Member Kasimu G. Kurfi Hon. Member | |||||

| THIS MONDAY 19TH DAY OF JUNE, 2023 | IST/LA/OA/01/2022 – Hearing of Motion IST/M/LA/14/2023 @ 9.00 am YAKUBU GARBA GOBIR V GREENWICH REGISTRARS & DATA SOLUTIONS LTD & 4 ORS | Amos I. Azi Hon. Chairman Jude I. Udunni Hon. Member Emeka C. Madubuike Hon. Member Kasimu G. Kurfi Hon. Member | |||||

| THIS MONDAY 19TH DAY OF JUNE, 2023 | IST/LA/OA/01/2023 – Hearing @ 9.00 am VESTRACT COMPANY LTD & ANOR V AGROPARTNERSHIPS LTD | Amos I. Azi Hon. Chairman Jude I. Udunni Hon. Member Albert L. Otesile Hon. Member Mamman B. Zargana Hon. Member | |||||

| THIS MONDAY 19TH DAY OF JUNE, 2023 | IST/LA/APP/01/2023 – Hearing @ 9.00 am TAJUDEEN ADEGBOYEGA AKANDE & 3 ORS V SECURITIES & EXCHANGE COMMISSION | Nosa Osemwengie Presiding Chairman Onyemaechi E. M. Elujekor Hon. Member Gboyega Oyekanmi Hon. Member Kasimu G. Kurfi Hon. Member | |||||

| THIS WEDNESDAY 15TH DAY OF MARCH, 2023 | IST/LA/OA/03/2022 – Ruling / Adoption of Addresses MISS PRINCESS C MEKWUNYE V UNION BANK OF NIGERIA PLC & 2 ORS @ 9.00 am | Onyemaechi E. M. Elujekor Presiding Chairman Dr. Abubakar A. Ahmad Hon. Member Emeka C. Madubuike Hon. Member Mamman B. Zargana Hon. Member Albert L. Otesile Hon. Member | |||||

| THIS WEDNESDAY 19TH DAY OF APRIL, 2023 | IST/LA/OA/07/2022 – Hearing of Pending Applications / Def. Hearing @ 9.00 am MR. TALIAT OLADAPO ADELEYE V CAPITAL TRUST BROKERS LTD & ANOR | Jude I. Udunni Presiding Chairman Dr. Abubakar A. Ahmad Hon. Member Kasimu G. Kurfi Hon. Member Emeka C. Madubuike Hon. Member | |||||

| THIS WEDNESDAY 15TH DAY OF MARCH, 2023 | IST/LA/OA/07/2022 – Def. Hearing MR. TALIAT OLADAPO ADELEYE V CAPITAL TRUST BROKERS LTD & ANOR @ 9.00 am | Jude I. Udunni Presiding Chairman Dr. Abubakar A. Ahmad Hon. Member Kasimu G. Kurfi Hon. Member Emeka C. Madubuike Hon. Member | |||||

| THIS WEDNESDAY 22ND DAY OF FEBRUARY, 2023 | . IST/LA/OA/04/2022 – Judgment MR. KOLAJO LAWAL & 13 ORS @ 9.00 am V FBN QUEST TRUSTEES LTD & ANOR CONSOLIDATED IST/LA/OA/05/2022 – MRS. ADEGUN ADENIKE V FBN QUEST TRUSTEES LTD & ANOR | Amos I. Azi Hon. Chairman Nosa Osemwengie Hon. Member Gboyega Oyekanmi Hon. Member Kasimu G. Kurfi Hon. Member Mamman Zargana Hon. Member | |||||

| THIS WEDNESDAY 15TH DAY OF FEBRUARY, 2023 | IST/LA/OA/03/2022 – Hearing of Applications / MISS PRINCESS C MEKWUNYE Adoption of Final Written V Addresses @ 9.00 am UNION BANK OF NIGERIA PLC & 2 ORS | Onyemaechi E. M. Elujekor Presiding Chairman Dr. Abubakar A. Ahmad Hon. Member Emeka C. Madubuike Hon. Member Mamman B. Zargana Hon. Member Albert L. Otesile Hon. Member | |||||

| THIS TUESDAY 14TH DAY OF FEBRUARY, 2023 | IST/LA/OA/06/2022 – Def. Hearing @ 9.00 am OLUSOLA AKINYEDE V STANBIC IBTC ASSET MANAGEMENT LTD & ANOR | Amos I. Azi Hon. Chairman Jude I. Udunni Hon. Member Gboyega Oyekanmi Hon. Member Kasimu G. Kurfi Hon. Member Mamman B. Zargana Hon. Member | |||||

| THIS TUESDAY 14TH DAY OF FEBRUARY, 2023 | IST/LA/OA/07/2022 – Def. Hearing MR. TALIAT OLADAPO ADELEYE @ 9.00 am V CAPITAL TRUST BROKERS LTD & ANOR | Jude I. Udunni Presiding Chairman Dr. Abubakar A. Ahmad Hon. Member Kasimu G. Kurfi Hon. Member Emeka C. Madubuike Hon. Member | |||||

| THIS MONDAY 13TH DAY OF FEBRUARY, 2023 | . IST/LA/OA/06/2022 – Def. Hearing @ 9.00 am OLUSOLA AKINYEDE V STANBIC IBTC ASSET MANAGEMENT LTD & ANOR | Amos I. Azi Hon. Chairman Jude I. Udunni Hon. Member Gboyega Oyekanmi Hon. Member Kasimu G. Kurfi Hon. Member Mamman B. Zargana Hon. Member | |||||

| THIS FRIDAY 6TH DAY OF JANUARY, 2023 | IST/LA/OA/01/2022 – Ruling /Judgment YAKUBU GARBA GOBIR @ 9.00 am V GREENWICH REGISTRARS & DATA SOLUTIONS LTD & 4 ORS | Amos I. Azi Hon. Chairman Jude I. Udunni Hon. Member Emeka C. Madubuike Hon. Member Kasimu G. Kurfi Hon. Member | |||||

| THIS FRIDAY 6TH DAY OF JANUARY, 2023 | . IST/LA/OA/06/2022 – Def. Hearing @ 9.00 am OLUSOLA AKINYEDE V STANBIC IBTC ASSET MANAGEMENT LTD & ANOR | Amos I. Azi Hon. Chairman Jude I. Udunni Hon. Member Gboyega Oyekanmi Hon. Member Kasimu G. Kurfi Hon. Member Mamman B. Zargana Hon. Member | |||||

| THIS FRIDAY 6TH DAY OF JANUARY, 2023 | . IST/LA/OA/03/2022 – Ruling MISS PRINCESS C MEKWUNYE @ 9.00 am V UNION BANK OF NIGERIA PLC & 2 ORS | Onyemaechi E. M. Elujekor Presiding Chairman Dr. Abubakar A. Ahmad Hon. Member Emeka C. Madubuike Hon. Member Mamman B. Zargana Hon. Member Albert L. Otesile Hon. Member | |||||

| THIS FRIDAY 6TH DAY OF JANUARY, 2023 | . IST/LA/OA/07/2022 – Hearing @ 9.00 am MR. TALIAT OLADAPO ADELEYE V CAPITAL TRUST BROKERS LTD & ANOR | Jude I. Udunni Presiding Chairman Dr. Abubakar A. Ahmad Hon. Member Kasimu G. Kurfi Hon. Member Emeka C. Madubuike Hon. Member | |||||

| THIS FRIDAY 6TH DAY OF JANUARY, 2023 | IST/LA/OA/02/2022 – Report of DOCTOR ADEBOYE ABIMBOLA OLUSEGUN KOFOWORADE Settlement V @ 9.00 am SECURITIES & EXCHANGE COMMISSION & 2 ORS | Nosa Osemwengie Presiding Chairman Onyemaechi E. M. Elujekor Hon. Member Albert L. Otesile Hon. Member Mamman B. Zargana Hon. Member | |||||

| THIS TUESDAY 22ND DAY OF NOVEMBER, 2022 | . IST/LA/OA/01/2022 – Hearing of Notice of YAKUBU GARBA GOBIR IST/M/LA/40/2022 Preliminary Objection V @ 9.00 am GREENWICH REGISTRARS & DATA SOLUTIONS LTD & 4 ORS | Amos I. Azi Hon. Chairman Jude I. Udunni Hon. Member Emeka C. Madubuike Hon. Member Kasimu G. Kurfi Hon. Member | |||||

| THIS TUESDAY 22ND DAY OF NOVEMBER, 2022 | . IST/LA/OA/04/2022 – Def. Hearing MR. KOLAJO LAWAL & 13 ORS @ 9.00 am V FBN QUEST TRUSTEES LTD & ANOR CONSOLIDATED IST/LA/OA/05/2022 – MRS. ADEGUN ADENIKE V FBN QUEST TRUSTEES LTD & ANOR | Amos I. Azi Hon. Chairman Nosa Osemwengie Hon. Member Gboyega Oyekanmi Hon. Member Kasimu G. Kurfi Hon. Member Mamman Zargana Hon. Member | |||||

| THIS TUESDAY 22ND DAY OF NOVEMBER, 2022 | IST/LA/OA/06/2022 – Hearing @ 9.00 am OLUSOLA AKINYEDE V STANBIC IBTC ASSET MANAGEMENT LTD & ANOR | Amos I. Azi Hon. Chairman Jude I. Udunni Hon. Member Gboyega Oyekanmi Hon. Member Kasumi G. Kurfi Hon. Member Mamman B. Zargana Hon. Member | |||||

| THIS TUESDAY 22ND DAY OF NOVEMBER, 2022 | . IST/LA/OA/03/2022 – Ruling / Hearing of MISS PRINCESS C MEKWUNYE Motion @ 9.00 am V UNION BANK OF NIGERIA PLC & 2 ORS | Onyemaechi E. M. Elujekor Presiding Chairman Dr. Abubakar A. Ahmad Hon. Member Emeka C. Madubuike Hon. Member Mamman B. Zargana Hon. Member Albert L. Otesile Hon. Member | |||||

| THURSDAY 13TH DAY OF OCTOBER, 2022 | IST/LA/APP/06/2021 – Ruling @ 9.00 am MR. OLADELE ODUSANYA PHILIP IST/M/LA/18/2022 V SECURITIES & EXCHANGE COMMISSION & ANOR | Amos I. Azi Hon. Chairman Nosa Osemwengie Hon. Member Kasimu G. Kurfi Hon. Member Mamman Zargana Hon. Member Gboyega Oyekanmi Hon. Member | |||||

| THURSDAY 13TH DAY OF OCTOBER, 2022 | IST/LA/OA/01/2022 – Def. Hearing YAKUBU GARBA GOBIR @ 9.00 am V GREENWICH REGISTRARS & DATA SOLUTIONS LTD & 4 ORS | Amos I. Azi Hon. Chairman Jude I. Udunni Hon. Member Emeka C. Madubuike Hon. Member Kasimu G. Kurfi Hon. Member | |||||

| THURSDAY 13TH DAY OF OCTOBER, 2022 | . IST/LA/OA/02/2022 – Report of DOCTOR ADEBOYE ABIMBOLA OLUSEGUN KOFOWORADE Settlement / Hearing V @ 9.00 am SECURITIES & EXCHANGE COMMISSION & 2 ORS | Nosa Osemwengie Presiding Chairman Onyemaechi E. M. Elujekor Hon. Member Albert L. Otesile Hon. Member Mamman B. Zargana Hon. Member | |||||

| THURSDAY 13TH DAY OF OCTOBER, 2022 | IST/LA/OA/03/2022 – Hearing MISS PRINCESS C MEKWUNYE @ 9.00 am V UNION BANK OF NIGERIA PLC & 2 ORS | Onyemaechi E. M. Elujekor Presiding Chairman Dr. Abubakar A. Ahmad Hon. Member Emeka C. Madubuike Hon. Member Mamman B. Zargana Hon. Member Albert L. Otesile Hon. Member | |||||

| THURSDAY 8TH DAY OF SEPTEMBER, 2022 | IST/LA/OA/01/2022 – Hearing @ 9.00 am YAKUBU GARBA GOBIR V GREENWICH REGISTRARS & DATA SOLUTIONS LTD & 4 ORS | Amos Azi [Hon. Chairman] Ike Udunni [Hon. Member] Abubakar A. Ahmad [Hon. Member] Kasumi G. Kurfi[Hon. Member] | |||||

| THURSDAY 8TH DAY OF SEPTEMBER, 2022 | IST/LA/APP/06/2021 IST/M/LA/18/2022– Hearing of Motion@ 9.00 am MR. OLADELE ODUSANYA PHILIP V SECURITIES & EXCHANGE COMMISSION & ANOR | Amos Azi [Hon. Chairman] Nosa Osemwengie [Hon. Member] Gboyega Oyekanmi [Hon. Member] Mamman Zargana [Hon. Member] Kasumi G. Kurfi[Hon. Member] | |||||

| WEDNESDAY 17TH DAY OF AUGUST, 2022 | IST/M/LA/25/2022 – MOTION EXPARTE @ 10.00 am MISS PRINCESS C. MEKWUNYE V UNION GLOBAL PARTNERS LTD & 4 ORS | Amos Azi [Hon. Chairman] Ahmad Abubakar[Hon. Member] Emeka Madubuike [Hon. Member] Otesile Albert[Hon. Member] Mamman B. Zargana[Hon. Member] | |||||

| WEDNESDAY 29TH DAY OF JUNE, 2022 | IST/LA/OA/01/2022 Hearing @ 9.00 am YAKUBU GARBA GOBIR V GREENWICH REGISTRARS & DATA SOLUTIONS LTD & 3 ORS | Amos I. Azi Hon. Chairman Jude I. Udunni Hon. Member Emeka C. Madubuike Hon. Member Kasimu G. Kurfi Hon. Member | |||||

| WEDNESDAY 29TH DAY OF JUNE, 2022 | IST/LA/APP/06/2021 IST/M/LA/18/2022 -Hearing of Motion @ 9.00 am MR. OLADELE ODUSANYA PHILIP V SECURITIES & EXCHANGE COMMISSION & ANOR | Amos I. Azi Hon. Chairman Nosa Osemwengie Hon. Member Kasimu G. Kurfi Hon. Member Mamman Zargana Hon. Member Gboyega Oyekanmi Hon. Member | |||||

| WEDNESDAY 29TH DAY OF JUNE, 2022 | IST/LA/OA/05/2021 Ruling @ 9.00 am MR. ADEGBOYEGA OYENIYI SHODUNKE V CASHCRAFT ASSET MANAGEMENT LTD & ANOR | Dr. Abubakar A. Ahmad Presiding Chairman Nosa Osemwengie Hon. Member Albert L. Otesile Hon. Member Kasimu G. Kurfi Hon. Member Mamman B. Zargana Hon. Member | |||||

| WEDNESDAY 29TH DAY OF JUNE, 2022 | IST/LA/OA/02/2022 Report of Settlement / Hearing @ 9.00 am DOCTOR ADEBOYE ABIMBOLA OLUSEGUN KOFOWORADE V SECURITIES & EXCHANGE COMMISSION & ANOR | Nosa Osemwengie Presiding Chairman Onyemaechi E. M. Elujekor Hon. Member Albert L. Otesile Hon. Member Mamman B. Zargana Hon. Member | |||||

| WEDNESDAY 29TH DAY OF JUNE, 2022 | IST/LA/OA/01/2021 IST/M/LA/17/2022 Hearing of Motion @ 9.00 am MEWA VENTURES LIMITED V MAINLAND TRUST LIMITED & 3 ORS | Onyemaechi E. M. Elujekor Presiding Chairman Amos I. Azi Hon. Member Dr. Abubakar A. Ahmad Hon. Member Kasimu G. Kurfi Hon. Member Mamman B. Zargana Hon. Member | |||||

| WEDNESDAY 29TH DAY OF JUNE, 2022 | IST/LA/OA/01/2022 – Hearing @ 9.00 am YAKUBU GARBA GOBIR V GREENWICH REGISTRARS & DATA SOLUTIONS LTD & 3 ORS | Amos I. Azi [Hon. Chairman] Jude I. Udunni [Hon. Member] Emeka C. Madubuike [Hon. Member Kasumi G. Kurfi [Hon. Member] | |||||

| WEDNESDAY 29TH DAY OF JUNE, 2022 | IST/LA/OA/05/2021 – Ruling @ 9.00 am MR. ADEGBOYEGA OYENIYI SHODUNKE V CASHCRAFT ASSET MANAGEMENT LTD & ANOR | Dr. Abubakar A. Ahmad [Presiding Chairman] Nosa Osemwengie [Hon. Member] Albert L. Otesile [Hon. Member] Kasumi G. Kurfi [Hon. Member] Mamman B. Zargana [Hon. Member] | |||||

| THURSDAY 19TH DAY OF MAY, 2022 | IST/LA/OA/05/2021 – Hearing @ 9.00 am MR. ADEGBOYEGA OYENIYI SHODUNKE V CASHCRAFT ASSET MANAGEMENT LTD & ANOR | Dr. Abubakar A. Ahmad Presiding Chairman Nosa Osemwengie Hon. Member Albert L. Otesile Hon. Member Kasumi G. Kurfi Hon. Member Mamman B. Zargana Hon. Member | |||||

| THURSDAY 19TH DAY OF MAY, 2022 | IST/LA/APP/02/2021 – Hearing of Motion CASHCRAFT ASSETS MANAGEMENT LTD & 17 ORS IST/M/LA/09/2022 @ 9.00 am V SECURITIES & EXCHANGE COMMISSION & ORS | Dr. Abubakar A. Ahmad Presiding Chairman Nosa Osemwengie Hon. Member Albert L. Otesile Hon. Member Mamman B. Zargana Hon. Member | |||||

| THURSDAY 19TH DAY OF MAY, 2022 | . IST/LA/OA/06/2021 – Ruling @ 9.00 am OLUSOLA AKINYEDE IST/M/LA/10/2022 V STANBIC IBTC ASSET MANAGEMENT LTD & ANOR | Amos I. Azi Hon. Chairman Jude I. Udunni Hon. Member Emeka C. Madubuike Hon. Member Gboyega Oyekanmi Hon. Member Kasumi G. Kurfi Hon. Member | |||||

| THURSDAY 19TH DAY OF MAY, 2022 | IST/LA/APP/06/2021 – Judgment @ 9.00 am MR. OLADELE ODUSANYA PHILIP V SECURITIES & EXCHANGE COMMISSION & ANOR | Amos I. Azi Hon. Chairman Nosa Osemwengie Hon. Member Kasumi G. Kurfi Hon. Member Mamman Zargana Hon. Member Gboyega Oyekanmi Hon. Member | |||||

| FRIDAY 20TH DAY OF MAY, 2022 | IST/LA/OA/02/2022 – Hearing DOCTOR ADEBOYE ABIMBOLA OLUSEGUN KOFOWORADE @ 9.00 am V SECURITIES & EXCHANGE COMMISSION & ANOR | Nosa Osemwengie Presiding Chairman Onyemaechi E. M. Elujekor Hon. Member Albert L. Otesile Hon. Member Mamman B. Zargana Hon. Member | |||||

| FRIDAY 20TH DAY OF MAY, 2022 | . IST/LA/APP/04/2021 – Hearing of Motion DR. ANDREWS ELUENI IST/M/LA/08/2022 @ 9.00 am V SECURITIES & EXCHANGE COMMISSION & ANOR | Onyemaechi E. M Elujekor Presiding Chairman Jude I. Udunni Hon. Member Emeka C. Madubuike Hon. Member Kasumi G. Kurfi Hon. Member | |||||

| FRIDAY 20TH DAY OF MAY, 2022 | IST/LA/APP/05/2021 – Hearing of Motion CHIEF JONATHAN ARAUSI IST/M/LA/07/2022 @ 9.00 am V SECURITIES & EXCHANGE COMMISSION & ANOR | Onyemaechi E. M Elujekor Presiding Chairman Jude I. Udunni Hon. Member Emeka C. Madubuike Hon. Member Kasumi G. Kurfi Hon. Member | |||||

| 20TH DAY OF MAY, 2022 | IST/LA/OA/01/2022 – Hearing @ 9.00 am YAKUBU GARBA GOBIR V GREENWICH REGISTRARS & DATA SOLUTIONS LTD & 3 ORS | Amos I. Azi Hon. Chairman Jude I. Udunni Hon. Member Emeka C. Madubuike Hon. Member Kasumi G. Kurfi Hon. Member | |||||

| TUESDAY 26TH DAY OF APRIL, 2022 | IST/LA/OA/06/2021 – Hearing of Motion IST/M/LA/10/2022 @ 9.00 am OLUSOLA AKINYEDE V STANBIC IBTC ASSET MANAGEMENT LTD & ANOR | Amos I. Azi [Hon. Chairman] Jude I. Udunni [Hon. Member] Emeka C. Madubuike [Hon. Member] Gboyega Oyekanmi [Hon. Member] Kasumi G. Kurfi [Hon. Member] | |||||

| TUESDAY 26TH DAY OF APRIL, 2022 | IST/LA/APP/03/2021 – Hearing of Motion IST/M/LA/06/2022 @ 9. 00 am BARRISTER TOM AWHANA V SECURITIES & EXCHANGE COMMISSION & ANOR | Onyemaechi E. M Elujekor [Presiding Chairman] Jude I. Udunni [Hon. Member] Emeka C. Madubuike [Hon. Member] Kasumi G. Kurfi [Hon. Member] | |||||

| TUESDAY 26TH DAY OF APRIL, 2022 | IST/LA/APP/05/2021 – Hearing of Motion IST/M/LA/07/2022 @ 9.00 am CHIEF JONATHAN ARAUSI V SECURITIES & EXCHANGE COMMISSION & ANOR | Onyemaechi E. M Elujekor [Presiding Chairman] Jude I. Udunni [Hon. Member] Emeka C. Madubuike [Hon. Member] Kasumi G. Kurfi [Hon. Member] | |||||

| TUESDAY 26TH DAY OF APRIL, 2022 | IST/LA/APP/04/2021 – Hearing of Motion IST/M/LA/08/2022 @ 9.00 am DR. ANDREWS ELUENI V SECURITIES & EXCHANGE COMMISSION & ANOR | Onyemaechi E. M Elujekor [Presiding Chairman] Jude I. Udunni [Hon. Member] Emeka C. Madubuike [Hon. Member] Kasumi G. Kurfi [Hon. Member] | |||||

| TUESDAY 26TH DAY OF APRIL, 2022 | IST/LA/APP/02/2021 – Hearing of Motion IST/M/LA/09/2022 @ 9.00 am CASHCRAFT ASSETS MANAGEMENT LTD & 17 ORS V SECURITIES & EXCHANGE COMMISSION & ORS | Dr. Abubakar A. Ahmad [Presiding Chairman] Nosa Osemwengie [Hon. Member] Albert L. Otesile [Hon. Member] Mamman B. Zargana [Hon. Member] | |||||

| TUESDAY 26TH DAY OF APRIL, 2022 | IST/LA/OA/05/2021 – Hearing @ 9.00 am MR. ADEGBOYEGA OYENIYI SHODUNKE V CASHCRAFT ASSET MANAGEMENT LTD & ANOR | Dr. Abubakar A. Ahmad [Presiding Chairman] Nosa Osemwengie [Hon. Member] Albert L. Otesile [Hon. Member] Kasumi G. Kurfi [Hon. Member] Mamman B. Zargana [Hon. Member] | |||||

| TUESDAY 15TH DAY OF MARCH, 2022 | IST/LA/APP/06/2021 – Hearing / Adoption of Briefs @ 9.00 am MR. OLADELE ODUSANYA PHILIP V SECURITIES & EXCHANGE COMMISSION & ANOR | Amos I. Azi [Hon. Chairman] Nosa Osemwengie [Hon. Member] Kasumi G. Kurfi [Hon. Member] Mamman Zargana [Hon. Member] Gboyega Oyekanmi [Hon. Member] | |||||

| TUESDAY 15TH DAY OF MARCH, 2022 | IST/LA/OA/06/2021 – Def. Hearing @ 9.00 am OLUSOLA AKINYEDE V STANBIC IBTC ASSET MANAGEMENT LTD & ANOR | Amos I. Azi [Hon. Chairman] Jude I. Udunni [Hon. Member] Emeka C. Madubuike [Hon. Member] Gboyega Oyekanmi [Hon. Member] Kasumi G. Kurfi [Hon. Member] | |||||

| TUESDAY 15TH DAY OF MARCH, 2022 | IST/LA/OA/05/2021 – Hearing @ 9.00 am MR. ADEGBOYEGA OYENIYI SHODUNKE V CASHCRAFT ASSET MANAGEMENT LTD & ANOR | Dr. Abubakar A. Ahmad Presiding Chairman Nosa Osemwengie Hon. Member Albert L. Otesile Hon. Member Kasumi G. Kurfi Hon. Member Mamman B. Zargana Hon. Member | |||||

| TUESDAY 22ND DAY OF FEBRUARY, 2022 | IST/LA/OA/06/2021 – Hearing @ 9.00 am OLUSOLA AKINYEDE V STANBIC IBTC ASSET MANAGEMENT LTD & ANOR | Amos I. Azi [Hon. Chairman] Jude I. Udunni [Hon. Member] Emeka C. Madubuike [Hon. Member] Gboyega Oyekanmi [Hon. Member] Kasumi G. Kurfi [Hon. Member] | |||||

| TUESDAY 22ND DAY OF FEBRUARY, 2022 | IST/LA/APP/07/2021 – Judgment @ 10.00 am BARRISTER TOM AWHANA DR. ANDREWS ELUENI CHIEF JONATHAN ARAUSI V SECURITIES & EXCHANGE COMMISSION & ANOR [CONSOLIDATED] | Onyemaechi E. M Elujekor [Presiding Chairman] Jude I. Udunni [Hon. Member] Emeka C. Madubuike [Hon. Member] Kasumi G. Kurfi [Hon. Member] | |||||

| TUESDAY 22ND DAY OF FEBRUARY, 2022 | IST/LA/OA/05/2021 – Hearing @ 9.00 am MR. ADEGBOYEGA OYENIYI SHODUNKE V CASHCRAFT ASSET MANAGEMENT LTD & ANOR | Dr. Abubakar A. Ahmad [Presiding Chairman] Nosa Osemwengie [Hon. Member] Albert L. Otesile [Hon. Member] Kasumi G. Kurfi [Hon. Member] Mamman B. Zargana [Hon. Member] | |||||

| 20TH DAY OF JANUARY 2022 | IST/LA/APP/06/2021 – Hearing @ 9.00 am MR. OLADELE ODUSANYA PHILIP V SECURITIES & EXCHANGE COMMISSION & ANOR | Amos I. Azi [Hon. Chairman] Nosa Osemwengie [Hon. Member] Kasumi G. Kurfi [Hon. Member] Mamman Zargana [Hon. Member] Gboyega Oyekanmi [Hon. Member] | |||||

| 22ND DAY OF FEBRUARY 2022 | IST/LA/APP/07/2021 – Judgment @ 10.00 am BARRISTER TOM AWHANA; DR. ANDREWS ELUENI; CHIEF JONATHAN ARAUSI [CONSOLIDATED] V SECURITIES & EXCHANGE COMMISSION & ANOR | Onyemaechi E. M Elujekor [Presiding Chairman] Jude I. Udunni [Hon. Member] Emeka C. Madubuike [Hon. Member] Kasumi G. Kurfi [Hon. Member] | |||||

| 9TH DAY OF DECEMBER, 2021 | IST/LA/OA/04/2021 – Report of Settlement / Def. Hearing @ 9.00 am JONCOD AGRO AND INDUSTRIAL EQUIPMENT MANUFACTURING COMPANY NIGERIA LIMITED VS CENTRAL SECURITIES CLEARING SYSTEM PLC & 4 ORS [CONSOLIDATED] | Amos I. Azi (Hon. Chairman) Dr. Abubakar A. Ahmad (Hon. Member) Kasumi G. Kurfi (Hon. Member) Emeka C. Madubuike (Hon. Member) | |||||

| 25TH DAY OF NOVMEMBER, 2021 | IST/LA/APP/06/2021 – Hearing @ 9:00am MR. OLADELE ODUSANYA PHILIP V SECURITIES & EXCHANGE COMMISSION & ANOR | Amos I. Azi (Hon. Chairman) Nosa Osemwengie (Hon. Member) Kasumi G. Kurfi (Hon. Member) Mamman Zargana (Hon. Member) Gboyega Oyekanmi (Hon. Member) | |||||

| 26TH DAY OF NOVEMBER, 2021 | IST/LA/APP/07/2021 – Adoption of Briefs @ 10:00am | Onyemaechi E. M Elujekor (Presiding Chairman) Jude I. Udunni (Hon. Member) Emeka C. Madubuike (Hon. Member) Kasumi G. Kurfi (Hon. Member) | |||||

| 25TH DAY OF OCTOBER, 2021 | IST/LA/OA/02/2021 – Report of Settlement / Def. Hearing @ 9.00 am JONCOD NIGERIA LIMITED V CENTRAL SECURITIES CLEARING SYSTEM PLC & 4 ORS | Amos I. Azi (Hon. Chairman) Dr. Abubakar A. Ahmad (Hon. Member) Kasumi G. Kurfi (Hon. Member) Emeka C. Madubuike (Hon. Member) | |||||

| 25TH DAY OF OCTOBER, 2021 | IST/LA/OA/03/2021 – Report of Settlement / Def. Hearing @ 9.00 am JONCOD AGRO AND INDUSTRIAL EQUIPMENT MANUFACTURING COMPANY NIGERIA LIMITED V CENTRAL SECURITIES CLEARING SYSTEM PLC & 4 ORS | Amos I. Azi (Hon. Chairman) Dr. Abubakar A. Ahmad (Hon. Member) Kasumi G. Kurfi (Hon. Member) Emeka C. Madubuike (Hon. Member) | |||||

| 25TH DAY OF OCTOBER, 2021 | IST/LA/APP/03/2021 – Hearing @ 12.00 Noon BARRISTER TOM AWHANA V SECURITIES & EXCHANGE COMMISSION & ANOR | Onyemaechi E. M Elujekor (Presiding Chairman) Jude I. Udunni (Hon. Member) Emeka C. Madubuike (Hon. Member) Kasumi G. Kurfi (Hon. Member) | |||||

| 25TH DAY OF OCTOBER, 2021 | IST/LA/APP/04/2021 – Hearing @ 12.00 Noon DR. ANDREWS ELUENI V SECURITIES & EXCHANGE COMMISSION & ANOR | Onyemaechi E. M Elujekor (Presiding Chairman) Jude I. Udunni (Hon. Member) Emeka C. Madubuike (Hon. Member) Kasumi G. Kurfi (Hon. Member) | |||||

| 25TH DAY OF OCTOBER, 2021 | IST/LA/APP/05/2021 – Hearing @ 12.00 Noon CHIEF JONATHAN ARAUSI V SECURITIES & EXCHANGE COMMISSION & ANOR | Onyemaechi E. M Elujekor (Presiding Chairman) Jude I. Udunni (Hon. Member) Emeka C. Madubuike (Hon. Member) Kasumi G. Kurfi (Hon. Member) | |||||

| 25TH DAY OF OCTOBER, 2021 | IST/LA/OA/01/14 – Hearing of Motion @ 9.00 am HELMSWORTH INVESTMENTS LIMITED & ANOR IST/M/LA/40/2021 V BGL SECURITIES LIMITED & 2 ORS | Jude I. Udunni Presiding Chairman Nosa Osemwengie Hon. Member Emeka C. Madubuike Hon. Member Mamman B. Zargana Hon. Member | |||||

| 26TH DAY OF OCTOBER, 2021 | IST/LA/APP/06/2021 – Hearing @ 9.00 am MR. OLADELE ODUSANYA PHILIP V SECURITIES & EXCHANGE COMMISSION & ANOR | Amos I. Azi (Hon. Chairman) Nosa Osemwengie (Hon. Member) Kasumi G. Kurfi (Hon. Member) Mamman Zargana (Hon. Member) Gboyega Oyekanmi (Hon. Member) | |||||

| 26TH DAY OF OCTOBER, 2021 | IST/LA/APP/01/2021 – Adoption of Briefs @ 9.00 am MR. ABOLADE AGBOLA V SECURITIES & EXCHANGE COMMISSION & 18 ORS | Dr. Abubakar A. Ahmad Presiding Chairman Amos I. Azi Hon. Member Onyemaechi E. M. Elujekor Hon. Member Albert L. Otesile Hon. Member | |||||

| 26TH DAY OF OCTOBER, 2021 | IST/LA/APP/02/2021 – Adoption of Briefs CASHCRAFT ASSETS MANAGEMENT LTD & 17 ORS @ 9.00 am V SECURITIES & EXCHANGE COMMISSION & 4 ORS | Dr. Abubakar A. Ahmad Presiding Chairman Nosa Osemwengie Hon. Member Albert L. Otesile Hon. Member Mamman B. Zargana Hon. Member | |||||

| 6TH OCTOBER, 2021 | IST/LA/OA/01/2021 – Judgment @ 9.00 am MEWA VENTURES LIMITED V MAINLAND TRUST LIMITED & 3 ORS | Onyemaechi E. M. Elujekor (Presiding Chairman) Amos I. Azi (Hon. Member) Dr. Abubakar A. Ahmad (Hon. Member) Kasumi G. Kurfi (Hon. Member) Mamman B. Zargana (Hon. Member) | |||||

| 14TH SEPTEMBER, 2021 | IST/LA/OA/02/2021 – Report of Settlement / Hearing @ 9.00 am JONCOD NIGERIA LIMITED V CENTRAL SECURITIES CLEARING SYSTEM PLC & 4 ORS | Amos I. Azi (Hon. Chairman) Dr. Abubakar A. Ahmad (Hon. Member) Kasumi G. Kurfi (Hon. Member) Emeka C. Madubuike (Hon. Member) | |||||

| 14TH SEPTEMBER, 2021 | 2. IST/LA/OA/03/2021 – Report of Settlement / Hearing @ 9.00 am JONCOD AGRO AND INDUSTRIAL EQUIPMENT MANUFACTURING COMPANY NIGERIA LIMITED V CENTRAL SECURITIES CLEARING SYSTEM PLC & 4 ORS | Amos I. Azi Hon. Chairman Dr. Abubakar A. Ahmad Hon. Member Kasumi G. Kurfi Hon. Member Emeka C. Madubuike Hon. Member | |||||

| 14TH SEPTEMBER, 2021 | 3. IST/LA/OA/03/2020 – Judgment @ 9. 00 am JOLA INVESTMENT LIMITED V KEYSTONE BANK PLC & ANOR | Jude I. Udunni Presiding Chairman Nosa Osemwengie Hon. Member Emeka C. Madubuike Hon. Member Kasumi G. Kurfi Hon. Member | |||||

| 14TH SEPTEMBER, 2021 | 4.IST/LA/OA/11/19 – Def. Hearing @ 9.00 am IGHODARO EDWARD OSARO V MAINLAND TRUST LIMITED & 3 ORS | Jude I. Udunni Presiding Chairman Nosa Osemwengie Hon. Member Albert L. Otesile Hon. Member Emeka C. Madubuike Hon. Member | |||||

| 14TH SEPTEMBER, 2021 | 5. IST/LA/APP/03/2021 – Hearing @ 9.00 am BARRISTER TOM AWHANA V SECURITIES & EXCHANGE COMMISSION & ANOR | Onyemaechi E. M Elujekor Presiding Chairman Jude I. Udunni Hon. Member Emeka C. Madubuike Hon. Member Kasumi G. Kurfi Hon. Member | |||||

| 14TH SEPTEMBER, 2021 | 6. IST/LA/APP/04/2021 – Hearing @ 9.00 am DR. ANDREWS ELEUNI V SECURITIES & EXCHANGE COMMISSION & ANOR | Onyemaechi E. M Elujekor Presiding Chairman Jude I. Udunni Hon. Member Emeka C. Madubuike Hon. Member Kasumi G. Kurfi Hon. Member | |||||

| 14TH SEPTEMBER, 2021 | 7. IST/LA/APP/05/2021 – Hearing @ 9.00 am CHIEF JONATHAN ARAUSI V SECURITIES & EXCHANGE COMMISSION & ANOR | Onyemaechi E. M Elujekor Presiding Chairman Jude I. Udunni Hon. Member Emeka C. Madubuike Hon. Member Kasumi G. Kurfi Hon. Member | |||||

| 15TH SEPTEMBER, 2021 | 1. IST/LA/OA/11/19 – Def. Hearing @ 9.00 am IGHODARO EDWARD OSARO V MAINLAND TRUST LIMITED & 3 ORS | Jude I. Udunni Presiding Chairman Nosa Osemwengie Hon. Member Albert L. Otesile Hon. Member Emeka C. Madubuike Hon. Member | |||||

| 15TH SEPTEMBER, 2021 | 2.IST/LA/APP/01/2021 – Adoption of Briefs @ 9.00 am MR. ABOLADE AGBOLA V SECURITIES & EXCHANGE COMMISSION & 18 ORS | Dr. Abubakar A. Ahmad Presiding Chairman Amos I. Azi Hon. Member Onyemaechi E. M. Elujekor Hon. Member Albert L. Otesile Hon. Member | |||||

| 15TH SEPTEMBER, 2021 | 3. IST/LA/APP/02/2021 – Adoption of Briefs @ 9.00 am CASHCRAFT ASSETS MANAGEMENT LTD & 17 ORS V SECURITIES & EXCHANGE COMMISSION & ANOR | Dr. Abubakar A. Ahmad Presiding Chairman Nosa Osemwengie Hon. Member Albert L. Otesile Hon. Member Mamman B. Zargana Hon. Member | |||||

| 18TH DAY OF AUGUST, 2021 | 1. IST/LA/OA/02/2021 – Final Report of Settlement/ Judgement @ 9.00 am JONCOD NIGERIA LIMITED V CENTRAL SECURITIES CLEARING SYSTEM PLC & 4 ORS | Amos I. Azi (Hon. Chairman) Dr. Abubakar A. Ahmad (Hon. Member) Kasumi G. Kurfi (Hon. Member) Emeka C. Madubuike (Hon. Member) | |||||

| 18TH DAY OF AUGUST, 2021 | 2. IST/LA/OA/03/2021 –Final Report of Settlement/ Judgement @ 9.00 am JONCOD AGRO AND INDUSTRIAL EQUIPMENT MANUFACTURING COMPANY NIGERIA LIMITED V CENTRAL SECURITIES CLEARING SYSTEM PLC & 4 ORS | Amos I. Azi (Hon. Chairman) Dr. Abubakar A. Ahmad (Hon. Member) Kasumi G. Kurfi (Hon. Member) Emeka C. Madubuike (Hon. Member) | |||||

| 30TH DAY OF JULY, 2021 | 1. IST/LA/OA/02/2021 – Final Report of Settlement/ Hearing of Preliminary Applications @ 9.00 am JONCOD NIGERIA LIMITED V CENTRAL SECURITIES CLEARING SYSTEM PLC & 4 ORS | Amos I. Azi (Hon. Chairman) Dr. Abubakar A. Ahmad (Hon. Member) Kasumi G. Kurfi (Hon. Member) Emeka C. Madubuike (Hon. Member) | |||||

| 30TH DAY OF JULY, 2021 | 2. IST/LA/OA/03/2021 – Final Report of Settlement/Hearing of Preliminary @ 9.00 am JONCOD AGRO AND INDUSTRIAL EQUIPMENT MANUFACTURING COMPANY NIGERIA LIMITED V CENTRAL SECURITIES CLEARING SYSTEM PLC & 4 ORS | Amos I. Azi (Hon. Chairman) Dr. Abubakar A. Ahmad (Hon. Member) Kasumi G. Kurfi (Hon. Member) Emeka C. Madubuike (Hon. Member) | |||||

| 7TH DAY OF JULY, 2021 | IST/LA/APP/02/2021 – Hearing @ 9.00 am CASHCRAFT ASSETS MANAGEMENT LTD & 17 ORS V SECURITIES & EXCHANGE COMMISSION & ANOR | Dr. Abubakar A. Ahmad (Presiding Chairman) Nosa Osemwengie Hon. Member Albert L. Otesile Hon. Member Mamman B. Zargana Hon. Member | |||||

| 7TH DAY OF JULY, 2021 | IST/LA/APP/03/2021 – Hearing @ 9.00 am BARRISTER TOM AWHANA V SECURITIES & EXCHANGE COMMISSION & ANOR | Onyemaechi E. M Elujekor (Presiding Chairman) Jude I. Udunni Hon. Member Emeka C. Madubuike Hon. Member Kasumi G. Kurfi Hon. Member | |||||

| 7TH DAY OF JULY, 2021 | IST/LA/APP/04/2021 – Hearing @ 9.00 am DR. ANDREWS ELEUNI V SECURITIES & EXCHANGE COMMISSION & ANOR | Onyemaechi E. M Elujekor (Presiding Chairman) Jude I. Udunni Hon. Member Emeka C. Madubuike Hon. Member Kasumi G. Kurfi Hon. Member | |||||

| 7TH DAY OF JULY, 2021 | IST/LA/APP/05/2021 – Hearing @ 9.00 am CHIEF JONATHAN ARAUSI V SECURITIES & EXCHANGE COMMISSION & ANOR | Onyemaechi E. M Elujekor (Presiding Chairman) Jude I. Udunni Hon. Member Emeka C. Madubuike Hon. Member Kasumi G. Kurfi Hon. Member | |||||

| 8TH DAY OF JULY, 2021 | IST/LA/OA/02/2021 – Report of Settlement/Def. Hearing @ 9.00 am JONCOD NIGERIA LIMITED V CENTRAL SECURITIES CLEARING SYSTEM PLC & 4 ORS | Amos I. Azi (Hon. Chairman) Dr. Abubakar A. Ahmad Hon. Member Kasumi G. Kurfi Hon. Member Emeka C. Madubuike Hon. Member | |||||

| 8TH DAY OF JULY, 2021 | IST/LA/OA/03/2021 – Report of Settlement/ Def. Hearing @ 9. 00 am@ 9.00 am JONCOD AGRO AND INDUSTRIAL EQUIPMENT MANUFACTURING COMPANY NIGERIA LIMITED V CENTRAL SECURITIES CLEARING SYSTEM PLC & 4 ORS | Amos I. Azi (Hon. Chairman) Dr. Abubakar A. Ahmad Hon. Member Kasumi G. Kurfi Hon. Member Emeka C. Madubuike Hon. Member | |||||

| 8TH DAY OF JULY, 2021 | IST/LA/OA/11/19 – Def. Hearing @ 9.00 am IGHODARO EDWARD OSARO V MAINLAND TRUST LIMITED & 3 ORS | Jude I. Udunni (Presiding Chairman) Nosa Osemwengie Hon. Member Albert L. Otesile Hon. Member Edward O. Ajayi Hon. Member Emeka C. Madubuike Hon. Member | |||||

| 8TH DAY OF JULY, 2021 | IST/LA/OA/01/2021 – Hearing @ 9.00 am MEWA VENTURES LIMITED V MAINLAND TRUST LIMITED & 5 ORS | Onyemaechi E. M. Elujekor (Presiding Chairman) Dr. Abubakar A. Ahmad Hon. Member Kasumi G. Kurfi Hon. Member Mamman B. Zargana Hon. Member | |||||

| 9TH DAY OF JULY, 2021 | IST/LA/OA/05/19 – Judgment @ 9:00am IST/LA/OA/07/19 – UREH AGNES NKEMDIRIM V AMYN INVESTMENT LTD & ANOR AND WILLIAM IHEANACHO NKEMDIRIM V AMYN INVESTMENT LTD & ANOR [CONSOLIDATED] | Jude I. Udunni (Presiding Chairman) Nosa Osemwengie Hon. Member Emeka C. Madubuike Hon. Member Edward O. Ajayi Hon. Member Mamman B. Zargana Hon. Member | |||||

| 9TH DAY OF JULY, 2021 | IST/LA/OA/05/19 – Judgment @ 9.00 am UREH AGNES NKEMDIRIM V AMYN INVESTMENT LTD & ANOR & WILLIAM IHEANACHO NKEMDIRIM IST/LA/OA/07/19 – V AMYN INVESTMENT LTD & ANOR | Nosa Osemwengie (Presiding Chairman) Albert L. Otesile Hon. Member Onyemaechi E. M. Elujekor Hon. Member Edward O. Ajayi Hon. Member Mamman B. Zargana Hon. Member | |||||

| 9TH DAY OF JULY, 2021 | IST/LA/OA/01/2021 – Hearing @ 9.00 am MEWA VENTURES LIMITED V MAINLAND TRUST LIMITED & 5 ORS | Onyemaechi E. M. Elujekor (Presiding Chairman) Dr. Abubakar A. Ahmad Hon. Member Kasumi G. Kurfi Hon. Member Mamman B. Zargana Hon. Member | |||||

| 9TH DAY OF JULY, 2021 | IST/LA/OA/03/2020 – Conclusion of Hearing @ 12. 00 Noon JOLA INVESTMENT LIMIT V KEYSTONE BANK PLC & ANOR | Jude I. Udunni (Presiding Chairman) Nosa Osemwengie Hon. Member Emeka C. Madubuike Hon. Member Edward O. Ajayi Hon. Member Kasumi G. Kurfi Hon. Member | |||||

| 16TH DAY OF JUNE, 2021 | IST/LA/OA/01/2021 – Def. Hearing @ 9.00 am MEWA VENTURES LIMITED V MAINLAND TRUST LIMITED & 5 ORS | Onyemaechi E. M. Elujekor (Presiding Chairman) Dr. Abubakar A. Ahmad (Hon. Member) Kasumi G. Kurfi (Hon. Member) Mamman B. Zargana (Hon. Member) | |||||

| 16TH DAY OF JUNE, 2021 | IST/LA/OA/03/2020 – Hearing @ 9.00 am JOLA INVESTMENT LIMITED V KEYSTONE BANK PLC & ANOR | Jude I. Udunni (Presiding Chairman) Nosa Osemwengie (Hon. Member) Emeka C. Madubuike (Hon. Member) Edward O. Ajayi (Hon. Member) Kasumi G. Kurfi (Hon. Member) | |||||

| 16TH DAY OF JUNE, 2021 | IST/LA/APP/01/2021 – Hearing @ 9.00 am MR. ABOLADE AGBOLA V SECURITIES & EXCHANGE COMMISSION & 18 ORS | Dr. Abubakar A. Ahmad (Presiding Chairman) Amos I. Azi (Hon. Member) Onyemaechi E. M. Elujekor (Hon. Member) Albert L. Otesile (Hon. Member) Edward O. Ajayi (Hon. Member) | |||||

| 17TH DAY OF MAY, 2021 | IST/LA/OA/03/2020 – Def. Hearing @ 9.00 am JOLA INVESTMENT LIMITED V KEYSTONE BANK PLC & ANOR | Jude I. Udunni (Presiding Chairman) Nosa Osemwengie (Hon. Member) Emeka C. Madubuike (Hon. Member) Edward O. Ajayi (Hon. Member) Kasumi G. Kurfi (Hon. Member) | |||||

| 17TH DAY OF MAY, 2021 | IST/LA/OA/11/19 – Hearing @ 9.00 am IGHODARO EDWARD OSARO V MAINLAND TRUST LIMITED & 3 ORS | Jude I. Udunni (Presiding Chairman) Nosa Osemwengie (Hon. Member) Albert L. Otesile (Hon. Member) Edward O. Ajayi (Hon. Member) Emeka C. Madubuike (Hon. Member) | |||||

| 17TH DAY OF MAY, 2021 | IST/LA/OA/10/19 – Hearing of Motion IST/M/LA/11/2021 @ 12 .00 Noon SECURITIES AND EXCHANGE COMMISSION V FIRST STOCKBROKERS LTD & 5 ORS | Dr. Abubakar A. Ahmad (Presiding Chairman) Nosa Osemwengie (Hon. Member) Albert L. Otesile (Hon. Member) Kasumi G. Kurfi (Hon. Member) Mamman B. Zargana (Hon. Member) | |||||

| 7TH DAY OF MAY, 2021 | IST/LA/OA/06/19 – Judgment @ 9.00 am IST/LA/OA/08/19 SAPID AGENCIES LTD V AMYN INVESTMENT LTD & ANOR & SAPID HAULAGE AND EQUIPMENT LTD V AMYN INVESTMENT LTD & ANOR | Nosa Osemwengie (Presiding Chairman) Albert L. Otesile (Hon. Member) Onyemaechi E. M. Elujekor (Hon. Member) Edward O. Ajayi (Hon. Member) Mamman B. Zargana (Hon. Member) | |||||

| 7TH DAY OF MAY, 2021 | IST/LA/OA/05/19 – Def. Hearing @ 9.00 am IST/LA/OA/07/19 UREH AGNES NKEMDIRIM V AMYN INVESTMENT LTD & ANOR & WILLIAM IHEANACHO NKEMDIRIM V AMYN INVESTMENT LTD & ANOR | Nosa Osemwengie (Presiding Chairman) Albert L. Otesile (Hon. Member) Onyemaechi E. M. Elujekor (Hon. Member) Edward O. Ajayi (Hon. Member) Mamman B. Zargana (Hon. Member) | |||||

| 6TH DAY OF MAY, 2021 | IST/LA/OA/02/2021 – Hearing @ 9.00 am JONCOD NIGERIA LIMITED V CENTRAL SECURITIES CLEARING SYSTEM PLC & 4 ORS | Amos I. Azi (Hon. Chairman) Dr. Abubakar A. Ahmad (Hon. Member) Kasumi G. Kurfi (Hon. Member) Emeka C. Madubuike (Hon. Member) | |||||

| 6TH DAY OF MAY, 2021 | IST/LA/OA/03/2021 – Hearing @ 9.00 am JONCOD AGRO AND INDUSTRIAL EQUIPMENT MANUFACTURING COMPANY NIGERIA LIMITED V CENTRAL SECURITIES CLEARING SYSTEM PLC & 4 ORS | Amos I. Azi (Hon. Chairman) Dr. Abubakar A. Ahmad (Hon. Member) Kasumi G. Kurfi (Hon. Member) Emeka C. Madubuike (Hon. Member) |

| SITTING DATE | CASE NO. | PANEL | ||

|---|---|---|---|---|

| THIS FRIDAY, THE 28th OF MARCH, 2025 | SUIT NO: IST/PH/0A/02/2024 FOR HEARING @ 9 AM BETWEEN MR. CHRISTIAN UDOH SAMBO CLAIMANT V. 1. UNITED BANK FOR AFRICA PLC 2. ASSET MGT. COMPANY OF NIGERIA (AMCON) 3. UNITED CAPITAL SECURITIES LTD 4. SECURITIES & EXCHANGE COMMISSION | Hon. Amos Isaac Azi Honourable Chairman Hon. Jude Udunni Member Hon. Gboyega Oyekanmi Member Hon. Mamman Bukar Zargana Member | ||

| THIS THURSDAY, THE 27th OF MARCH, 2025 | SUIT NO: IST/PH/OA/01/2025 FOR HEARING @ 9AM BETWEEN PARETO FUNDS & SECURITIES LTD ……………… CLAIMANT V. 1.AUTOMARINE LTD 2.DIMARINE NIG. LTD 3.JOEXPORA NIG .LTD 4.EVERYDAY GROUP OF CO. LTD 5. EBERE DIMNWOBI 6.JOHN DIMNWOBI 7.CHARLES DIMNWOBI 8.SECURITIES & EXCHANGE COMMISSION | Hon. Amos Isaac Azi Honourable Chairman Hon. Jude Udunni Member Hon. Gboyega Oyekanmi Member Hon. Mamman Bukar Zargana Member | ||

| THIS WEDNESDAY, THE 5TH DAY OF MARCH, 2025 | . SUIT NO: IST/PH/OA/02/24 FOR HEARING @ 9AM BETWEEN MR. CHRISTIAN UDOH SAMBO ………………… CLAIMANT V. 1.UNITED BANK FOR AFRICA PLC 2.ASSET MGT COMPANY OF NIGERIA (AMCON) 3.UNITED CAPITAL SECURITIES LTD 4.SECURITIES & EXCHANGE COMMISSION | Hon. Amos Isaac Azi Presiding Chairman Hon. Jude Udunni Member Hon. Gboyega Oyekanmi Member Hon. Mamman Bukar Zargana Member | ||

| THIS WEDNESDAY, THE 5TH DAY OF MARCH, 2025 | SUIT NO: IST/PH/OA/02/2025 FOR HEARING @ 9AM BETWEEN UDUAGHAN JOHN TORITSEJU ……………… CLAIMANT V. 1. CASHCRAFT ASSET MANAGEMENT LTD 2. CASHCRAFT SECURITIES LTD DEFENDANTS 3. SECURITIES & EXCHANGE COMMISSION | Hon. Amos Isaac Azi Presiding Chairman Hon. Jude Udunni Member Hon. Gboyega Oyekanmi Member Hon. Mamman Bukar Zargana Member | ||

| THIS WEDNESDAY, THE 29TH OF JANUARY, 2025 | SUIT NO: IST/PH/0A/02/2024 FOR HEARING @ 9 AM BETWEEN MR. CHRISTIAN UDOH SAMBO CLAIMANT V. 1.UNITED BANK FOR AFRICA PLC 2.ASSET MGT. COMPANY | Hon. Amos Isaac Azi Presiding Chairman Hon. Gboyega Oyekanmi Member Hon. Jude Udunni Member Hon. Mamman Bukar Zargana Member | ||

| THIS WEDNESDAY, THE 29TH OF JANUARY, 2025 | SUIT NO: IST/PH/0A/02/2024 FOR HEARING @ 9 AM BETWEEN MR. CHRISTIAN UDOH SAMBO CLAIMANT V. 1. UNITED BANK FOR AFRICA PLC 2. ASSET MGT. COMPANY DEFENDANTS | Hon. Amos Isaac Azi Presiding Chairman Hon. Gboyega Oyekanmi Member Hon. Jude Udunni Member Hon. Mamman Bukar Zargana Member | ||

| TUESDAY, THE 28TH OF JANUARY, 2025 | SUIT NO: IST/PH/0A/02/2024 FOR HEARING @ 9 AM BETWEEN MR. CHRISTIAN UDOH SAMBO CLAIMANT V. 1. UNITED BANK FOR AFRICA PLC 2. ASSET MGT. COMPANY DEFENDANTS | Hon. Amos Isaac Azi Presiding Chairman Hon. Gboyega Oyekanmi Member Hon. Jude Udunni Member Hon. Mamman Bukar Zargana Member | ||

| 27TH DAY OF SEPTEMBER, 2022 | IST/PH/OA/01/22 – For Definite Hearing @ 9:00am Abok Nyam – (Claimants) V Elixir Asset Management Limited Elixir Investment Partners Limited Securities and Exchange Commission (SEC) | Hon. Amos I. Azi [Hon. Chairman] Hon. Abubakar A. Ahmad [Member] Hon. Gboyega Oyekanmi [Member] Hon. Kasimu G. Kurfi [Member] | ||

| 27TH DAY OF SEPTEMBER, 2022 | IST/PH/OA/02/22 – For Definite Hearing @ 9:00am So-Wills Multipurpose Resources Ltd – (Claimants) V Elixir Asset Management Limited Elixir Investment Partners Limited Securities and Exchange Commission (SEC) | Hon. Amos I. Azi [Hon. Chairman] Hon. Abubakar A. Ahmad [Member] Hon. Gboyega Oyekanmi [Member] Hon. Kasimu G. Kurfi [Member] | ||

| 27TH DAY OF SEPTEMBER, 2022 | IST/PH/OA/03/22 – For Definite Hearing @ 9:00am Stip International Global Resources Ltd – (Claimants) V Elixir Asset Management Limited Elixir Investment Partners Limited Securities and Exchange Commission (SEC) | Hon. Amos I. Azi [Hon. Chairman] Hon. Abubakar A. Ahmad [Member] Hon. Gboyega Oyekanmi [Member] Hon. Kasimu G. Kurfi [Member] | ||

| 28TH DAY OF SEPTEMBER, 2022 | IST/PH/OA/01/22 – For Definite Hearing @ 9:00am Abok Nyam – (Claimants) V Elixir Asset Management Limited Elixir Investment Partners Limited Securities and Exchange Commission (SEC) | Hon. Amos I. Azi [Hon. Chairman] Hon. Abubakar A. Ahmad [Member] Hon. Gboyega Oyekanmi [Member] Hon. Kasimu G. Kurfi [Member] | ||

| 28TH DAY OF SEPTEMBER, 2022 | IST/PH/OA/02/22 – For Definite Hearing @ 9:00am So-Wills Multipurpose Resources Ltd – (Claimants) V Elixir Asset Management Limited Elixir Investment Partners Limited Securities and Exchange Commission (SEC) | Hon. Amos I. Azi [Hon. Chairman] Hon. Abubakar A. Ahmad [Member] Hon. Gboyega Oyekanmi [Member] Hon. Kasimu G. Kurfi [Member] | ||

| 28TH DAY OF SEPTEMBER, 2022 | IST/PH/OA/03/22 – For Definite Hearing @ 9:00am Stip International Global Resources Ltd – (Claimants) V Elixir Asset Management Limited Elixir Investment Partners Limited Securities and Exchange Commission (SEC) | Hon. Amos I. Azi [Hon. Chairman] Hon. Abubakar A. Ahmad [Member] Hon. Gboyega Oyekanmi [Member] Hon. Kasimu G. Kurfi [Member] | ||

| 26TH DAY OF JULY, 2022 | IST/PH/OA/01/22 – For Definite Hearing @ 9:00am Abok Nyam – (Claimants) V Elixir Asset Management Limited Elixir Investment Partners Limited Securities and Exchange Commission (SEC) | Hon. Amos I. Azi [Hon. Chairman] Hon. Abubakar A. Ahmad [Member] Hon. Gboyega Oyekanmi [Member] Hon. Kasimu G. Kurfi [Member] | ||

| 27TH DAY OF JULY, 2022 | IST/PH/OA/02/22 – For Hearing @ 9:00am So-Wills Multipurpose Resources Ltd – (Claimants) V Elixir Asset Management Limited Elixir Investment Partners Limited Securities and Exchange Commission (SEC) Trustees, Investors Protectors Fund | Hon. Amos I. Azi [Hon. Chairman] Hon. Abubakar A. Ahmad [Member] Hon. Gboyega Oyekanmi [Member] Hon. Kasimu G. Kurfi [Member] | ||

| 27TH DAY OF JULY, 2022 | IST/PH/OA/03/22 – For Hearing @ 9:00am Stip International Global Resources Ltd – (Claimants) V Elixir Asset Management Limited Elixir Investment Partners Limited Securities and Exchange Commission (SEC) Trustees, Investors Protectors Fund | Hon. Amos I. Azi [Hon. Chairman] Hon. Abubakar A. Ahmad [Member] Hon. Gboyega Oyekanmi [Member] Hon. Kasimu G. Kurfi [Member] | ||

| 16TH DAY OF JUNE, 2022 | IST/PH/OA/01/22 – For Hearing @ 9:00am Abok Nyam – (Claimants) V Elixir Asset Management Limited Elixir Investment Partners Limited Securities and Exchange Commission (SEC) | Hon. Amos I. Azi [Hon. Chairman] Hon. Abubakar A. Ahmad [Member] Hon. Gboyega Oyekanmi [Member] Hon. Kasimu G. Kurfi [Member] | ||

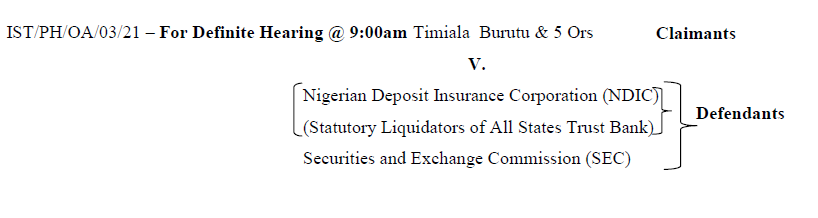

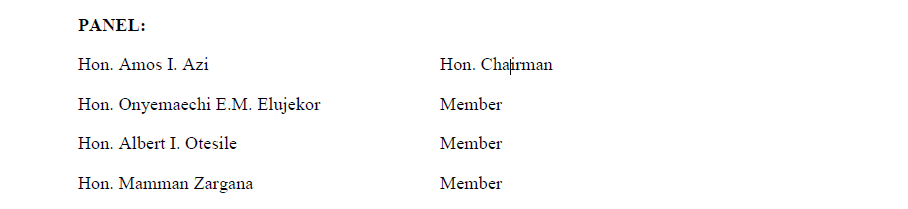

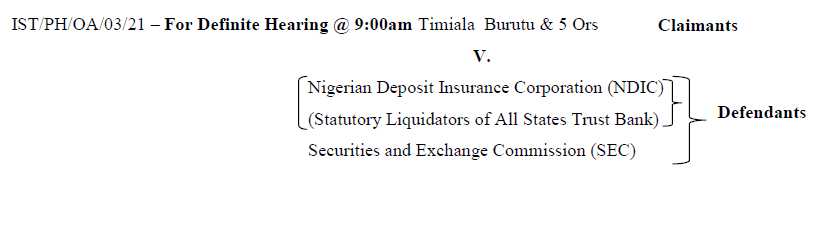

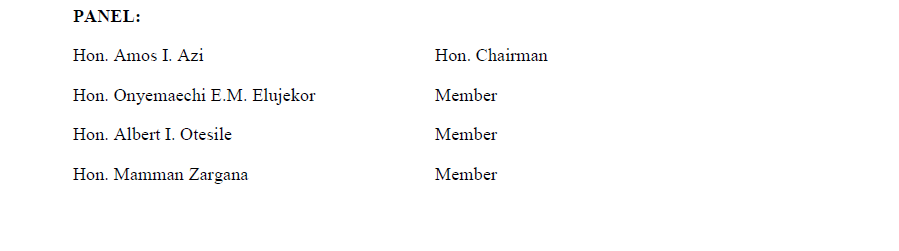

| 14TH DAY OF APRIL, 2022 | IST/PH/OA/03/21 – FOR JUDGMENT@9:00am Timiala Burutu & 5 Ors – [Claimants] Vs [Nigerian Deposit Insurance Corporation (NDIC) Statutory Liquidators of All States Trust Bank] Securities and Exchange Commission} Defendants | Hon. Amos I. Azi [Hon. Chairman] Hon. Onyemaechi E.M. Elujekor [Member] Hon. Albert I. Otesile [Member] Hon. Mamman Zargana [Member] | ||

| 18TH DAY OF JANUARY, 2022 | For Definite Hearing @ 9:00am Timiala Burutu & 5 Ors – [Claimants] v. [[Nigerian Deposit Insurance Corporation (NDIC), Statutory Liquidators of All States Trust Bank] Securities and Exchange Commission (SEC) ] – Defendants | Hon. Amos I. Azi [Hon. Chairman] Hon. Onyemaechi E.M. Elujekor [Member] Hon. Albert I. Otesile [Member] Hon. Mamman Zargana [Member] | ||

| 19TH DAY OF JANUARY, 2022 | IST/PH/OA/03/21– For Continuation of Hearing @ 9:00am Timiala Burutu & 5 Ors – [Claimant] v. [[Nigerian Deposit Insurance Corporation (NDIC), Statutory Liquidators of All States Trust Bank] Securities and Exchange Commission (SEC) ]] – Defendants | Hon. Amos I. Azi [Hon. Chairman] Hon. Onyemaechi E.M. Elujekor [Member] Hon. Albert I. Otesile [Member] Hon. Mamman Zargana [Member] | ||

| 18TH DAY OF JANUARY, 2022 |  |  | ||

| 19TH DAY OF JANUARY, 2022 |  |  | ||

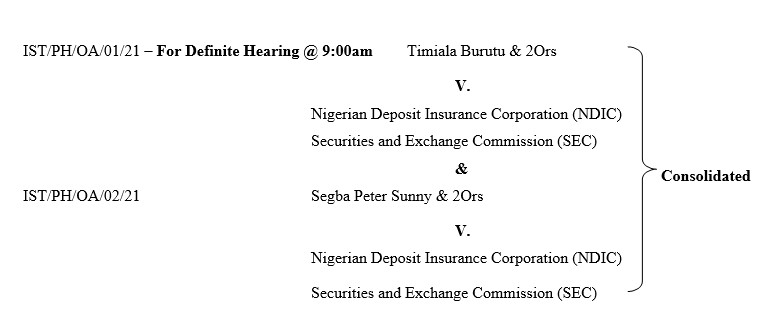

| 21TH DAY OF JUNE, 2021 | IST/PH/OA/01/21 – For Definite Hearing @ 9:00am Timiala Burutu & 2Ors – Claimants V. Nigerian Deposit Insurance Corporation (NDIC) Securities and Exchange Commission (SEC) } Defendants | Hon. Amos I. Azi (Hon. Chairman) Hon. Onyemaechi E.M. Elujekor (Member) Hon. Albert I. Otesile (Member) Hon. Mamman Zargana (Member) | ||

| 21TH DAY OF JUNE, 2021 | IST/PH/OA/02/21 – For Definite Hearing @ 9:00am Segba Peter Sunny & 2Ors – Claimants V. Nigerian Deposit Insurance Corporation (NDIC) Securities and Exchange Commission (SEC) } Defendants | Hon. Amos I. Azi (Hon. Chairman) Hon. Onyemaechi E.M. Elujekor (Member) Hon. Albert I. Otesile (Member) Hon. Mamman Zargana (Member) | ||

| 20TH DAY OF MAY, 2021 | IST/PH/OA/01/2021: Hearing TIMIALA BURUTU & 2 ORS V. NIGERIA DEPOSIT INSURANCE CORP. & ANOR. | Amos I. Azi (Hon. Chairman) Onyemachi E. M. Elujekor (Hon. Member) Albert L. Otesile (Hon. Member) Mamman Zargana (Hon. Member) | ||

| Hon. Amos I. Azi (Hon. Chairman) Hon. Onyemaechi E.M. Elujekor (Member) Hon. Albert I. Otesile (Member) Hon. Mamman Zargana (Member) | |||

| 20TH DAY OF MAY, 2021 | IST/PH/OA/02/2021: Hearing SEGBA PETER SUNNY V. NIGERIA DEPOSIT INSURANCE CORP. & ANOR | Amos I. Azi (Hon. Chairman) Onyemachi E. M. Elujekor (Hon. Member) Albert L. Otesile (Hon. Member) Mamman Zargana (Hon. Member) | ||

| 21ST DAY OF MAY, 2021 | IST/PH/OA/03/19: Judgment @ 9.00am OMASIRICHI AMADI VICTOR V. CASHCRAFT ASSET MAGT. LTD. & ANOR. | Jude I. Udunni (Presiding Chairman) Nosa Osemwengie (Hon. Member) Kasumi G. Kurfi (Hon. Member) Emeka Madubuike (Hon. Member) Edward Ajayi (Hon. Member) |

| SITTING DATE | CASE NO. | PANEL |

|---|---|---|

| THIS TUESDAY, THE 13TH DAY OF DECEMBER, 2022. | IST/KN/OA/01/2022-for Hearing @ 10:00am Zayyana Umar V. United Bank for Africa & 2 Others | Amos I. Azi Presiding Chairman Gboyega Oyekanmi Hon. Member Abubakar A. Ahmad Hon. Member Kasimu G. Kurfi Hon. Member Albert Otesile Hon. Member |

| Case No. | Parties | Judgement Date | Action |

|---|---|---|---|

| IST/OA/03/2003 | CSCS & NSE V BONKOLANS INVESTMENTS LIMITED & 5 OTHERS | 29/10/2004 | View |

| IST/OA/06/06 | CHIEF LIVINUS EZEMEGBE V NIGERIAN STOCK EXCHANGE & ANOR | 13/12/2006 | View |

| IST/OA/17/07 | SECURITIES AND EXCHANGE COMMISSION V ALLGREEN INVESTMENTS NIG. LTD | 03/07/2008 | View |

| IST/OA/03/19 | WINNERS MEDICAL V ECOBANK & 7 ORS | 15/01/2021 | |

| IST/LA/OA/06/19 | SAPID HAULAGE AND EQUIPMENT LTD V AMYN INVESTMENTS LTD & SECURITIES AND EXCHANGE COMMISSION | 07/05/2021 | View |

| IST/PH/OA/03/19 | OMASIRICHI AMADI VICTOR V CASHCRAFT ASSET MANAGEMENT LIMITED & SECURITIES AND EXCHANGE COMMISSION | 21/05/2021 | View |

| View |